When precious metals are out-performing other asset classes, it usually means that Silver is also out-performing Gold.

Silver means to Gold what small-caps and growth stocks mean to the broader stock market. Precious metals bulls want to see Silver leading Gold higher to signal a “risk-on” environment for metals trading.

All you have to do is look at the surge in precious metals this year. Gold is up and Silver is way up.

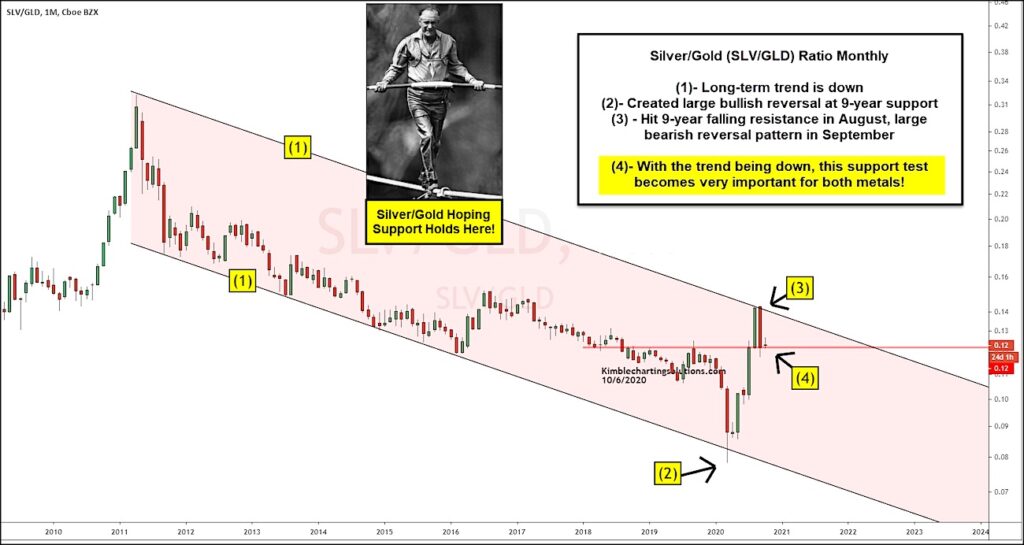

BUT that could all be changing. Precious metals have seen some selling recently with silver leading the way lower. Looking at today’s “monthly” chart of the Silver/Gold price ratio, we can see a large reversal in September at (3) and some early uncertainty in October. This has lead to an important test of support at (4).

Precious metals bulls do NOT want to see this ratio slip below support! Stay tuned!

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.