The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Better-than-expected results in big tech lifts S&P 500 EPS growth for Q1 2023, now set to come in at -3.7%

- Potential earnings surprises this week: Marriott International

- Names to watch during the second peak week: AAPL, SBUX, BUD, AMD, UBER, YUM

- Peak weeks for Q1 season from April 24 – May 12

Earnings Recap – Big Tech Saves the Day

First quarter 2023 peak earnings season started out last week with a sour earnings report from First Republic bank which revealed deposits fell 40% during the quarter. In the April 10 research note, we pointed out that the regional bank had confirmed a later than expected earnings date, 11 days later to be exact, noting that this was a bearish sign for the upcoming earnings call. After rising ahead of the announcement, the stock is now down 75% since that report, and further news that the bank would likely not be rescued and instead taken into receivership by the FDIC.

However, starting on Tuesday big tech swooped in to save the day. Alphabet, Microsoft, Meta and Amazon all reported better than expected earnings and revenue results and mostly bullish guidance, lifting the Dow Jones to its best monthly gain since January. Widespread layoffs appear to have helped improve margins for many tech companies, with more announcements coming in last week for workforce reductions at Lyft and Dropbox.

Robust results in the last week brings the current S&P 500 growth rate up to -3.7% from -6.2% the week prior.¹ We’re still on track for an “earnings recession” as it is unlikely that results will be so good for the quarter that we emerge from negative growth territory, but it’s certainly shaping up better-than-expected, with 79% of companies beating EPS estimates.

Potential Earnings Surprises this Week – Marriott International

With an earlier than expected earnings date for the world’s largest hotel chain, travel demand appears to have recovered from pandemic-caused losses.

Marriott International (MAR)

Company Confirmed Report Date: Tuesday, May 2, BMO

Projected Report Date (based on historical data): Thursday, May 4, BMO

DateBreaks Factor: 2*

Marriott is set to report Q1 2023 results on Tuesday, May 2. While this is only two days earlier than anticipated, it does push MAR’s Q1 report date into the 18th week of the year, rather than the long-term trend of reporting during the 19th or 20th week of the year.

Academic research shows when a corporation reports earnings earlier than they have historically, it typically signals good news to come on the conference call. This narrative could make sense for Marriott as travel demand in the US has been high, especially as we head into peak travel season. Large international carriers such as Delta, American Airlines and United have already reported for Q1 and commented on the strength in travel demand as well as record advanced bookings for this coming summer.

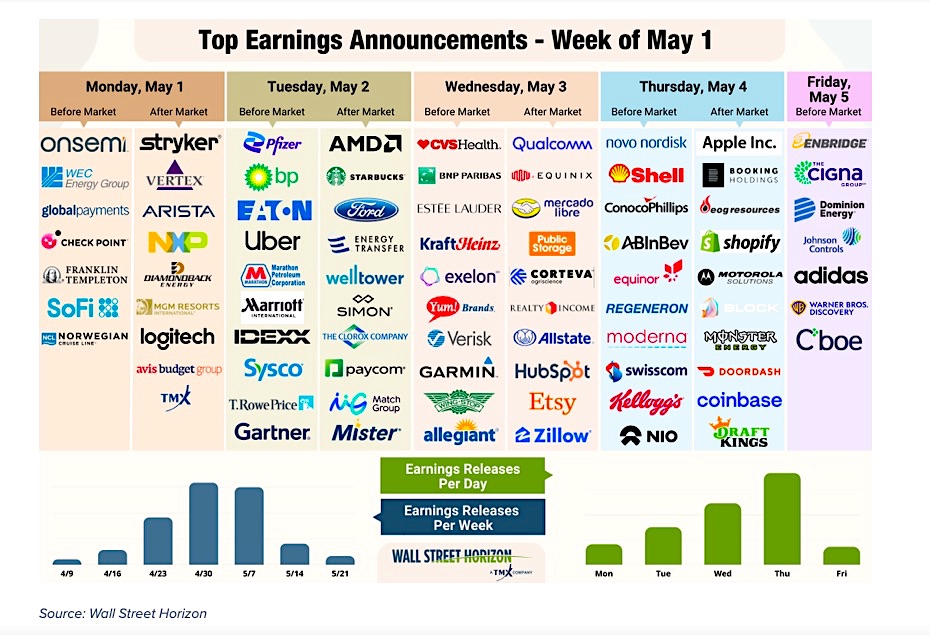

On Deck this Week:

This week will mark the second of peak earnings season, with 2,333 companies in our universe of nearly 10,000 global equities slated to release results for the first quarter. Tech will still be in focus with Apple (AAPL) results out on Thursday AMC, as well as results from internet service companies such as Shopify (SHOP), Etsy (ETSY) and Zillow (Z), and internet tech names such as Atlassian (TEAM) and Hubspot (HUBS). We’ll also be getting a smattering of reports from other sectors, with companies like Uber (UBER), Starbuck (SBUX) and Yum! Brands (YUM) all in focus.

Q1 Earnings Wave

This season peak weeks will fall between April 24 – May 12, with each week expected to see over 1,000 reports. Currently May 11 is predicted to be the most active day with 963 companies anticipated to report. Thus far 73% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

¹ https://advantage.factset.com/hubfs

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.