The US Dollar’s summer rally has applied additional pressure on the precious metals sector.

Is it coming to an end now?

Precious metals bulls should tune into the currency markets for clues. And not just King Dollar… But also the Swiss Franc. It’s past predictive powers have been pretty good.

Below we take a look at the US Dollar and Swiss Franc charts to see what they’re telling precious metals investors.

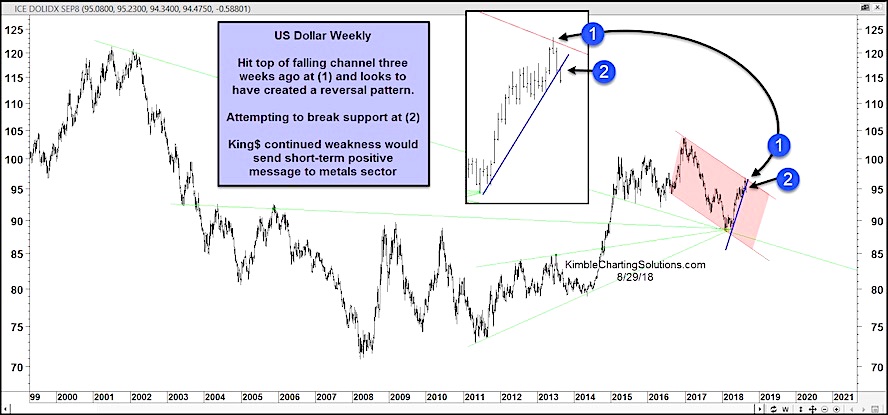

US Dollar Chart

King Dollar hit resistance at the top of a falling channel a few weeks ago (point 1) and looks to have created a reversal pattern. The ensuing move lower has King Dollar attempting to break a steep support line (point 2).

Continued weakness in the US Dollar would send a short-term positive message to precious metals bulls.

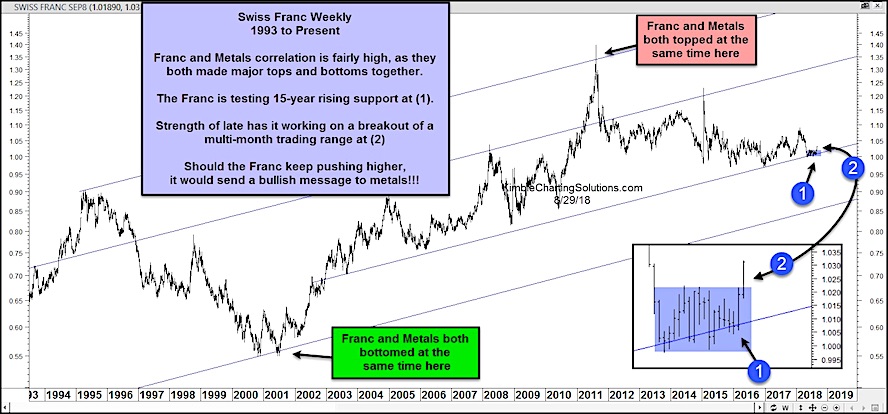

Swiss Franc Chart

The Swiss Franc is attempting to break above multi-month resistance (point 2 – see little box below). This comes after holding channel support at point 1.

Bulls would love to see King Dollar breakdown further and the Franc continue its path higher. Should this occur, it would send a bullish message to precious metals. Stay tuned!

Note that KimbleCharting is offering a 30 day Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.