Today PepsiCo (PEP), Hershey (HSY), Starbucks (SBUX) and Clorox (CLX) joined the Facebook (FB) advertising boycott.

This news comes after other major brands such as Unilever and Coca Cola (KO) also paused advertising on the company’s social media platforms.

On Friday, Facebook CEO, Mark Zuckerberg, outlined steps that the company will take against hate speech and racism including the removal of posts that incite violence and adding warning labels to posts that could be hate speech.

The stock is down about 10.3% from the all-time highs made on 6/23/20.

And as of 2:30 PM ET, Facebook (FB) is trading up $3.70 or 1.71%.

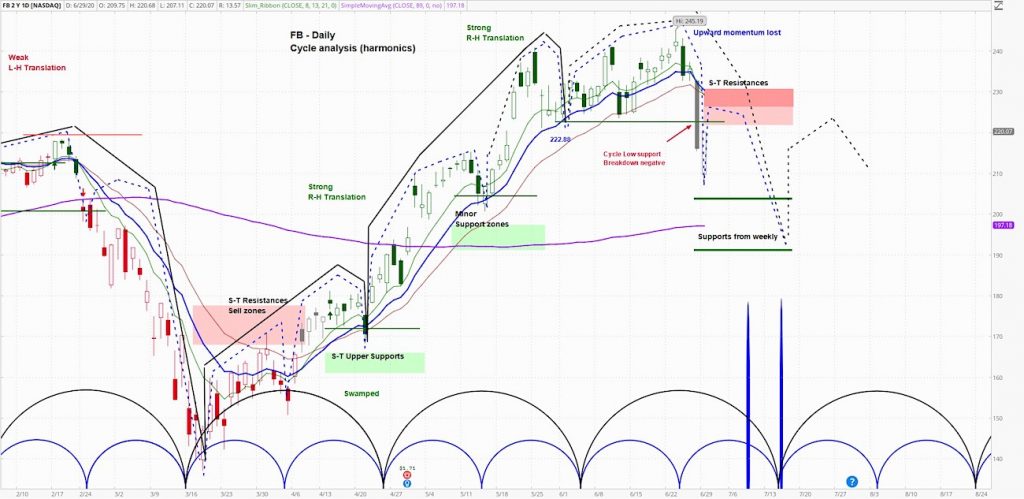

Let’s review our daily cycle chart.

Facebook (FB) Daily Chart

At askSlim.com we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing:

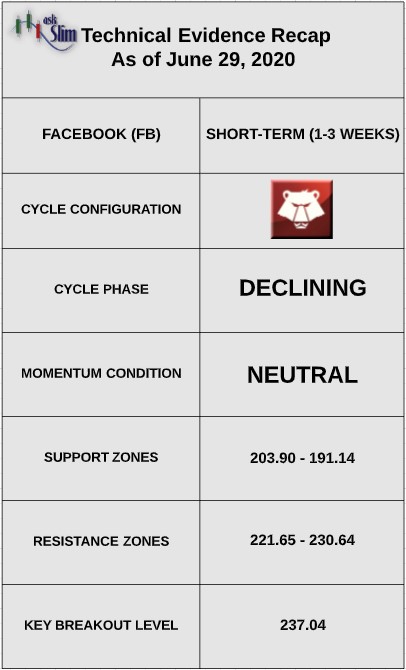

The daily cycle analysis suggests that FB has broken below a key cycle low support at 222.88.

Daily momentum is now neutral. The next short-term low is due between 7/7 – 7/15.

On the upside, there are short-term Fibonacci resistances from 221.65 – 230.64.

On the downside, there are intermediate-term Fibonacci supports from 203.90 – 191.14.

For the bulls to regain control of the intermediate-term, we would need to see a daily close back over 237.04.

askSlim Sum of the Evidence:

FB has broken below an important prior cycle low support and has likely formed an intermediate-term high. There is a likelihood that the stock tests the weekly Fibonacci support zone beginning at 204 by mid-July.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.