Since December 2022, we have been bullish gold in anticipation of its most recent run.

From the start of 2023, I went on the media telling viewers to buy gold and hold it. I believed that gold would double (it was trading $1500 at the time).

And if gold did not double, I believed it would at least be a hedge against any chaos and run up much higher.

Furthermore, I often wrote how chaos can present in many ways from explosive debt to weather catastrophes to war.

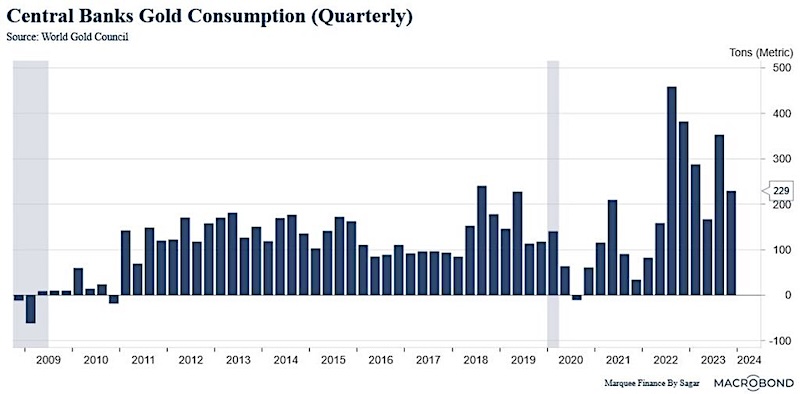

The chart below shows the huge amount of buying by global central banks.

In 2022, with interest rates rising and the dollar remaining strong, banks accumulated gold.

In 2023, with growth stocks roaring, the economy hanging tough, rates and inflation peaking, banks accumulated gold.

In 2024, with the Dow and SPY making new all-time highs, central banks accumulated gold.

Why?

Besides banks, Wells Fargo estimates that Costco is selling as much as $200 MILLION in gold bars monthly.

Gold rush?

However, the retail investor is still not fully positioned in gold futures or in GLD, the gold ETF, which makes this chart even more bullish.

In my 2024 Outlook I wrote that “gold and silver will start their last hurrah. We plan to ride the wave, and then exit and move on.”

Let’s not forget that silver too has now joined the party with higher industrial demand and lower inventories.

What I meant by “exit and move on” is that I am making another bold prediction.

Once this rally ends-and that could be this year, or in another year from now, we will take our money off the table and walk away from the precious metals-indefinitely.

After all, at this point, the PMs are not moving a lot higher because of runaway inflation like they did in the late 1970s.

Currently, gold is running because of fear of more chaos.

And silver is running out of fear of not enough supply (and more chaos-poor man’s gold).

The idea of reflation has its part of this of course, but we believe that both gold and silver will continue to go parabolic for now because of these unique set of reasons.

And that once those reasons go away, so will the need for both metals at lofty prices.

But let’s not think about that for now.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.