Earlier this month Expedia (EXPE) announced a $3.9B cash and stock deal for HomeAway. While it isn’t expected to be completed until the first quarter of 2016, the acquisition of the home vacation rental company puts them in a position to compete with the industry leader Airbnb. If it gets regulatory approval it would mean nearly $8B in deals in just two years for Expedia.

And this could mean upside for Expedia’s stock price near-term.

In September, Expedia closed their previously largest purchase of rival Orbitz for $1.6B. Trivago, Travelocity, Wotif are some other notable brands they’ve recently added to their portfolio to stay competitive with Priceline.com (PCLN).

Expedia stock (EXPE) trades at a P/E ratio of 20.02x (2016 estimates), price to sales ratio of 2.48x, and a price to book ratio of 6.43x. Revenue growth is expected to accelerate to 25% next year ($8.3B+) from an impressive 16% due to the aforementioned M&A activity and solid organic sales as well.

Currently Wall Street analysts have a consensus price target of $137.73 (14 buy ratings, 10 hold ratings, 0 sell ratings). Following the better than expected Q3 results and the HomeAway deal, S&P Capital IQ reiterated their buy rating.

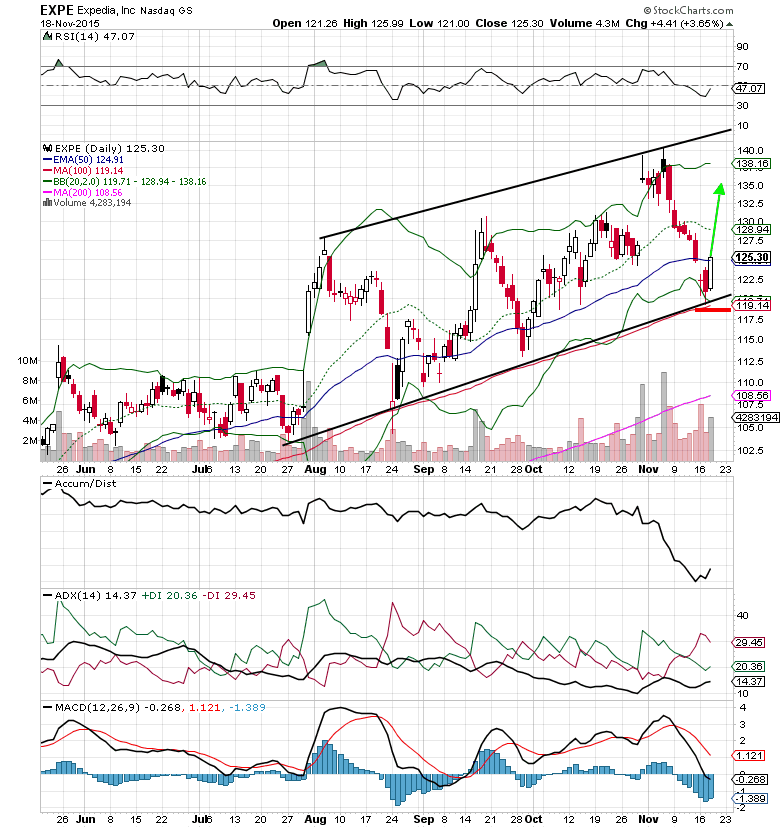

And looking at the chart below, it looks like Expedia’s stock price may be setting up for a rally off lower trend channel support.

Expedia (EXPE) Stock Chart – Technical Analysis

Looking at the 6-month daily chart above we can see EXPE shares have been trading in a nice uptrending channel since late July. The month of November hasn’t treated investors with nice returns so far, but it did end a 9 day losing streak on Wednesday, which coincidentally happened right at the test of the 100-day simple moving average (and the bottom of the channel). One might consider a long position in the stock now, using a stop loss under $119. A move back into the mid $130’s is a reasonable target, with potential for low $140’s by the beginning of the new year.

Expedia Options Trade Idea

One could buy the Jan 15 2016 $125/$140 bull call spread for a $5.50 debit or so.

This entails buying the Jan 15 2016 $125 EXPE call and selling the Jan 15 2016 $140 EXPE call, all in one trade.

Stop loss- $1.95

1st upside target- $10.00

2nd upside target- $14.00

Thanks for reading and have a great weekend.

Twitter: @MitchellKWarren

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.