The all options covered write strategy is also known as a leveraged covered call. In fact, back on the old trading floor we used to call it a Fig Leaf (don’t ask me why).

The all options covered write strategy is also known as a leveraged covered call. In fact, back on the old trading floor we used to call it a Fig Leaf (don’t ask me why).

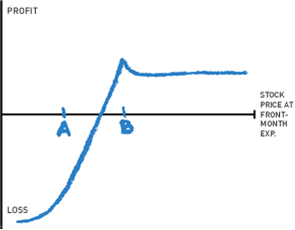

The idea is based on a covered write but using long term options (2 or more years duration), known as LEAPS (Long term Equity Appreciation Strategies) as a stock substitute. You own an in the money LEAPS call and sell a 2 or 3 month out of the money call against it. The strategy looks like this (lower right graph):

Notice that the profit and loss lines are not straight. That’s because the LEAPS call is still open when the shorter-term call expires. Straight lines and hard angles usually indicate that all options in the strategy have the same expiration date.

You want the LEAPS call to track the movement of the stock, so you want to choose an option with a Delta of around 80, about 20% in the money. If the stock is particularly volatile you want to choose an option even deeper in the money.

The advantage of this strategy over a conventional covered write is that you don’t have to commit as much capital. Of course, you are long an option and not the stock, so you do not collect any dividends along the way.

Another hazard is if your short term call expires in the money and you are assigned. You don’t want to exercise your LEAPS early because of all the time value you would be throwing away. And you probably don’t want the strategy to turn into long call/short stock because then you have a synthetic long put. If the short leg looks to expire in the money it is best to unwind the whole position. Which, because your long leg is deeper in the money than your short leg, you should be able to do this for a profit.

It’s basically a neutral-bullish strategy. Ideally you want your short leg to expire worthless then sell a new short leg and keep doing that, collecting that expired premium, until you have the LEAPS for free.

Your worst case scenario is that the stock goes dramatically lower so whatever premium you collect does not make up for your loss on the LEAPS.

As I have said previously, I am not a big fan of covered writes in general because all they really are is a synthetic short put. But, if covered writes are your thing, better all options than options plus stock, in my view.

For more information please visit my website: www.thelissreport.com.

Twitter: @RandallLiss

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.