The stock market enjoyed a post-election rally last week that carried the Dow Jones Industrials (NYSEARCA:DIA) to its best weekly gain in five years – the index also hit new record highs. The mood of investors shifted virtually overnight on the realization that the new administration’s economic policies, specifically a reduction in regulations, lower tax rates, increased spending on infrastructure projects, as well as encouraging multinationals to repatriate overseas profits with tax incentives, will spur economic growth.

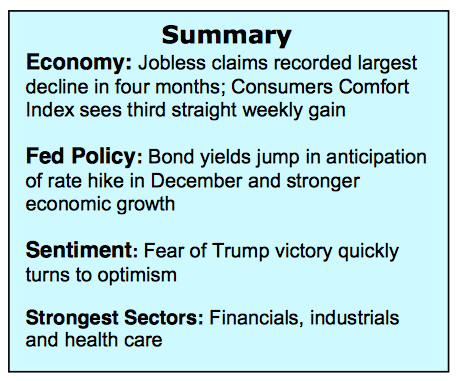

Additionally, the election news coincided with a third-quarter recovery in earnings and improved economic data. This appears to have the makings of a new market paradigm.

The financial markets reacted accordingly with stocks soaring and bond prices suffering. Small-cap stocks were the big winners with the Russell 2000 Index (INDEXRUSSELL:RUT) soaring more than 10% over the five-day period. Small-size companies, due to the high cost of excessive regulation, suffered the most in recent years and are expected to benefit from reduced pressure from government.

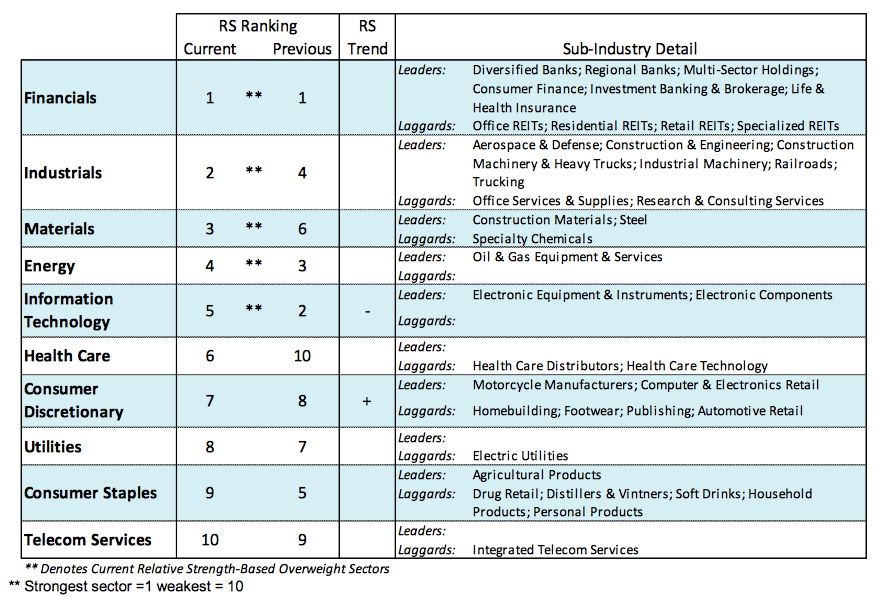

In addition to small cap stocks, the sectors best positioned in the new market paradigm include the financials, industrials and health care. Entering the new week stocks are overbought, which could result in short-term volatility. Looking further out, the prospects for a stronger economy, improved corporate profits and the potential for the flow of funds out of bonds and into equities argues for higher prices. The largest threat is that interest rates could experience a significant rise (3.00% on the 10-year T-note) which would impact the economy and equity markets. A significant jump in bond yields is unlikely given that rates overseas are expected to remain low and it will take time to implement new pro-growth themes the new administration is expected to propose.

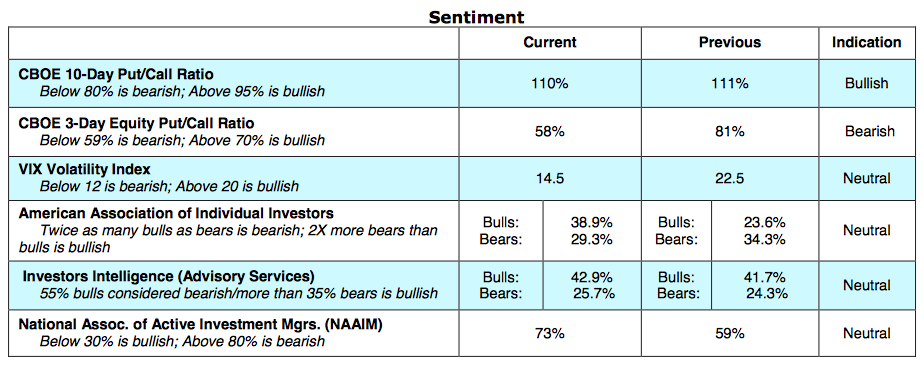

The technical condition of the equity markets improved last week. Most important, market breadth expanded significantly with new 52-week highs on the NYSE and NASDAQ surging to the best levels in two years. In addition, the percentage of industry groups within the S&P 500 climbed to 58% from 50% the previous week. The marked improvement in market breadth suggests that the current rally has more room on the upside. Investor sentiment, that was excessively pessimistic in the days leading up to the election, reversed as optimism returned. Shortly before the vote, the demand for put options soared to levels last seen in August 2015 when stocks were headed for a steep correction. Additionally, the CBOE Volatility Index (VIX-14) jumped above 20 signifying that fear had entered the building. This is in sharp contrast to what occurred following the election as seen in Thursday’s investor survey report from the American Association of Individual Investors (AAII). The AAII data showed that bullish sentiment surged to its highest level in more than a year and the largest weekly increase in more than six years. The improvement in investor sentiment is interpreted as a tailwind for stocks until such time that it becomes excessive or extreme. Stocks are likely to become vulnerable should the AAII survey show 2.5X as many bulls than bears and a VIX reading below 12.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.