IPOs are back in vogue and this is putting it mildly.

According to Renaissance Capital, 275 companies went public in 2014, almost ten times more than the number of offerings in 2008 and the highest level since 2000.

As the interest in IPOs has increased among the investing public there has been a predictable rise in attention-grabbing headlines about different aspects of the IPO process and their potentially sinister and lurking dangers.

The topic that seems to attract the most hysteria is the IPO Lockup Expiration. Law prohibits insiders and major shareholders from selling their shares for a predetermined period of time, typically between 90 and 180 days. This rule was established to prevent IPOs from turning into massive pump-and-dump schemes. As part of the IPO process, each company is required to announce the IPO lockup expiration date well in advance.

There are many articles out there advising investors to stay away from a stock when the insiders are finally allowed to sell. Even the usually level-headed Investopedia strikes a fairly dramatic tone in this article:

…The problem is, when lockups expire all the insiders are permitted to sell their stock. The result is a rush of people trying to sell their stock to realize their profit…

You won’t have a hard time finding other articles on the same theme and same “rush to sell” phrase regarding IPO lockup expirations.

The warnings seem to reach a crescendo when the IPO lockup expiration date for a popular IPO is near, as was the case with Alibaba (BABA) just this past week.

With Alibaba’s IPO lockup expiration scheduled for March 18, there was much collective hand-wringing about the millions of shares Wall Street fat cats and company management were about to unleash on the mom and pop investors.

As March 18 dawned, BABA shares were understandably under pressure in the pre-market.

When the opening bell rang and flood gates were officially opened, the stock opened lower and then … well … wait for it … wait for it … rallied!!

BABA closed that day higher by about +0.6%. Wait, what?

This was not the first time I have witnessed this version of the stock market’s Chicken Little and it motivated me to find out what really happens with IPO lockup expirations.

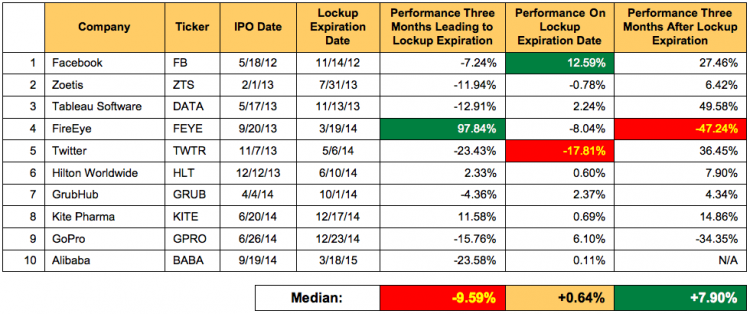

From the roughly 500 companies that went public in the last two years, I selected 10 of the biggest and most followed issues and looked at their stock price around the IPO lockup expiration timeframe. Sample size of 2% may not seem statistically representative but focusing on the biggest and most visible IPOs should give us a fairly good idea of what happens.

Specifically, I wanted to see what the performance of each new issue looked like in the three months leading up to IPO lockup expiration, on the very day of expiration, and then three months after.

The performance and results are summarized in the table below (data from nasdaq.com and yahoo.com):

As expected, there are a few outliers in this group, the biggest being FireEye (FEYE), which nearly doubled leading to the lockup expiration and then lost almost 50% of its value in the following months.

The majority of these IPOs, however, had price behavior that was the exact OPPOSITE of the “insiders-rush-to-sell” school of thought. Check out the list of names, including the likes of Facebook (FB) and Twitter (TWTR).

Seven of the ten declined in the three months leading to the expiration by a median amount of -9.6%. Just like BABA, seven of the ten rallied on the day of the expiration by a median amount of +0.64% (Note: I used “median” instead of “average” as it is less susceptible to being skewed by big outliers).

Finally, at least seven (it’s too early to tell about BABA) advanced three months following lockup expiration, the median performance being +7.9%.

Why is this happening?

Obviously, a good deal of stock price dynamics is unique to each company and there will always be stocks that decline on and after the lockup expiration date.

In general though, stock price behavior associated with IPO lockup expiration seems to run contrary to conventional wisdom and scary headlines.

I believe this behavior is consistent with a well-functioning market and shareholders acting in their best long-term interest:

- The Market is a Discounting Mechanism: All known and publicly available information about a stock is “priced in” well in advance of any known event. Lockup expiration dates are publicly announced several months ahead of time so it is no surprise that many of the IPOs trade lower leading into the event. Provided nothing unexpected happens on the actual expiration date, prospective investors will start to accumulate stock causing it to rise following lockup expiration.

- Major Shareholders Are Not Dumb: Most major shareholders are long-term investors with a time horizon well beyond the IPO or lockup expiration date. Even if they are shorter term speculators they are well aware that dumping their shares as soon as they are allowed is far from an optimal strategy to maximize the value of their investment

- Most Insiders Are Business Owners: The majority of company insiders are people who had invested an incredible amount of time and effort growing their company and taking it public. They understandably have a great deal of passion for the business and believe it will continue growing for a long time. Consequently, it is not reasonable to expect them to dump their hard-earned equity stakes within a few months of the IPO.

The popular narrative about market behavior frequently involves nefarious motives and deeds. However, if you take the time to understand what goes on, more often than not you will find that many market dynamics are a result of rational actions by buyers and sellers.

In the case of IPO lockup expirations, it is best to ignore the headlines and conventional wisdom and focus on what the proverbial “smart money” is doing.

Thanks for reading and have a great week!

Follow Drasko on Twitter: @NoanetTrader

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.