The NYFANG+ index of leading growth stocks is up about 12% YTD, while the S&P 500 and Nasdaq 100 have gained only 5%. While stocks like NVDA are making headlines, it’s important here to watch names that have recently gapped higher.

In a bull market phase, leading stocks will break out, and then price will often move even higher as additional buyers are willing to pay more and more for winning names.

In a bearish phase, however, gaps higher will often stall out, representing an exhaustion of buyers. If there aren’t willing buyers willing to pay more and more for those stocks, the uptrends will fizzle out!

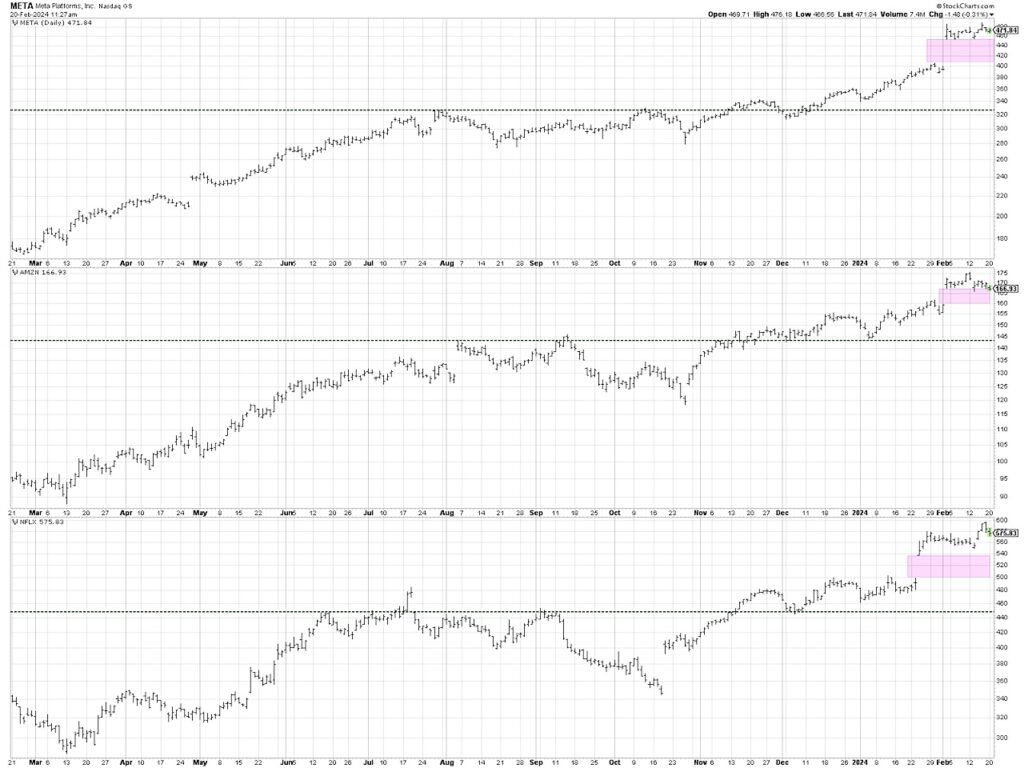

In today’s video, we’ll break down the similarities in the charts of META, NFLX, and AMZN. Will these three leading growth stocks hold their price gaps from earlier in 2024, or will they break down and signal a broader market selloff into March?

- What can a stock’s performance around a price gap tell us about investor sentiment and risk appetite?

- Why should we pay more attention to stalled out rallies as opposed to stocks in relentless uptrends like NVDA?

- Will February and March follow the traditional seasonal pattern of weakness in an election year?

Video: 3 Important technology stocks decline into price gaps

$META $AMZN $NFLX stock charts

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.