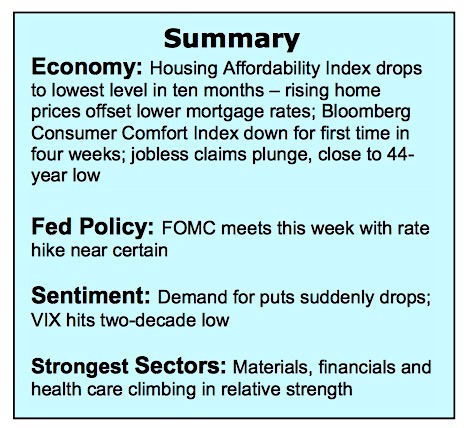

The Dow Jones Industrials (INDEXDJX:.DJI) reached a record high last week but the best performance was seen in small-cap indices including the Russell 2000 Index (INDEXRUSSELL:RUT) which gained more than 1.00%.

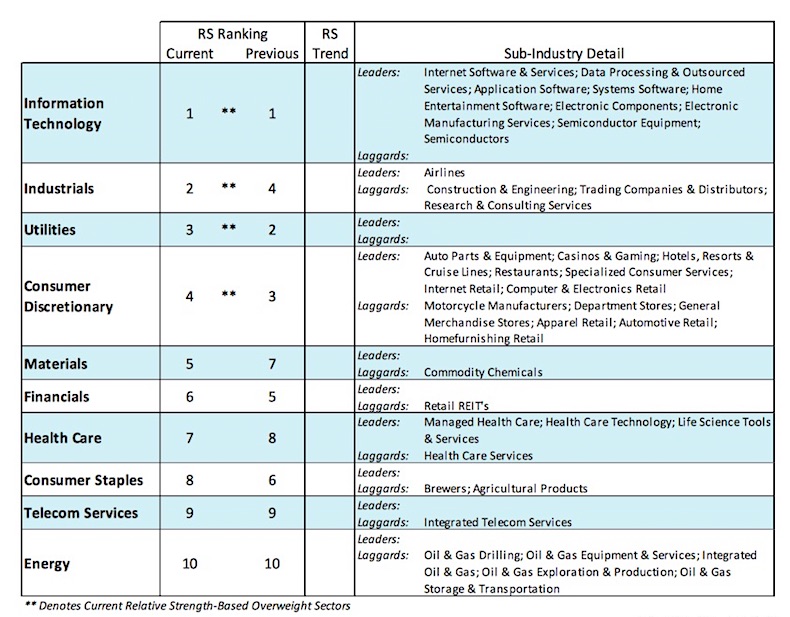

A rotation away from the 2017 market leaders into previously underperforming sectors is considered a potentially bullish development for the stock market.

Stock Market Update: Sector Rotation Underway?

A major concern has been that only a small group of stocks representing slightly more than 1.0% of the S&P 500 Index (INDEXSP:.INX) have a weighting of more than 13%. Nearly 40% of the gain in the S&P 500 this year is attributed to just five issues. Extremely narrow leadership is often seen near the end of a bull market. One week’s performance cannot be considered a trend, but should the emphasis continue to shift away from a handful of stocks into a broader range of groups and sectors it would be a healthy development that could significantly extend the life of the bull market.

The fact that the materials sector soared to a record high last week also has bullish ramifications. Raw material prices are a dependable leading indicator of economic strength. A continued rally in the energy, materials and financial sectors would argue that the U.S. economy is gaining momentum and that the strong earnings growth recorded in the first quarter could persist in 2017. Fed Chief Janet Yellen is widely anticipated to raise the fed funds level 25 basis points on Wednesday. A rate increase is fully priced into the financial markets and suggests that the Fed believes business conditions are strong enough to absorb higher interest costs. The markets will be more focused on what the Fed will do in the second half of the year which could keep markets on the defensive into the news.

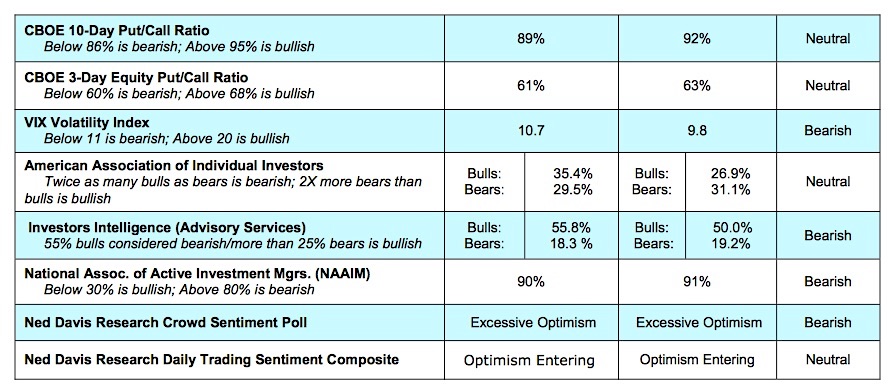

The technical condition of the stock market continues to favor the upside. The strongest evidence that further upside progress can be expected can be found in the long-term trend, which is positive for the U.S. equity markets and also seen in most foreign markets. Strong upside momentum was lost late in the first quarter and has yet to resurface. Following the three-month consolidation phase, we were anticipating a breakout to new highs that would be accompanied by one or more sessions where upside volume exceeded downside volume by a ratio of 10-to-1 or more. This has led to a market that has grinded higher on the back of just a few stocks. At the start of June, only three S&P 500 sectors were trading above their 200-day moving average. The reversal in the technology sector last week could spark the broadening trend into more groups and sectors, which has bullish ramifications. Investor sentiment turned more optimistic last week as the demand for puts weakened. The percentage of Wall Street advisors with a bullish view rose sharply and the survey from the American Association of Individual Investors (AAII) showed move bulls than bears, completely opposite the data from the previous week.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.