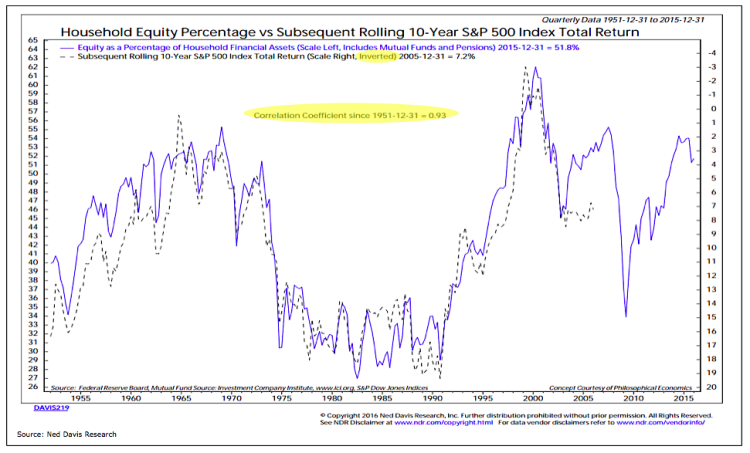

The chart shown here (to the right) is drawn from quarterly Federal Reserve data and is even more comprehensive than the ICI data. Household exposure to equities remains elevated, not quite at levels seen in 2000 and 2007, but certainly above the long-term average.

There is a strong inverse correlation between household exposure to equities and forward stock market returns. When equities exposure has been low, subsequent returns for stocks have been elevated. When equities exposure has been relatively high (as is currently the case) forward returns have been more muted. While the flow data may offer a tactically bullish view on stocks, investors continue to hold elevated exposure to equities, cash remains relatively scarce, and risks are still high.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.