Key Takeaway: Bond yields are moving off of early year lows at a time when bond funds have seen a surge in inflows and optimism around bonds is excessive. Rising inflation, weakness in the dollar, and moves toward policy normalization by the Federal Reserve could add fuel to the rise in bond yields and that might be a good thing for the economy.

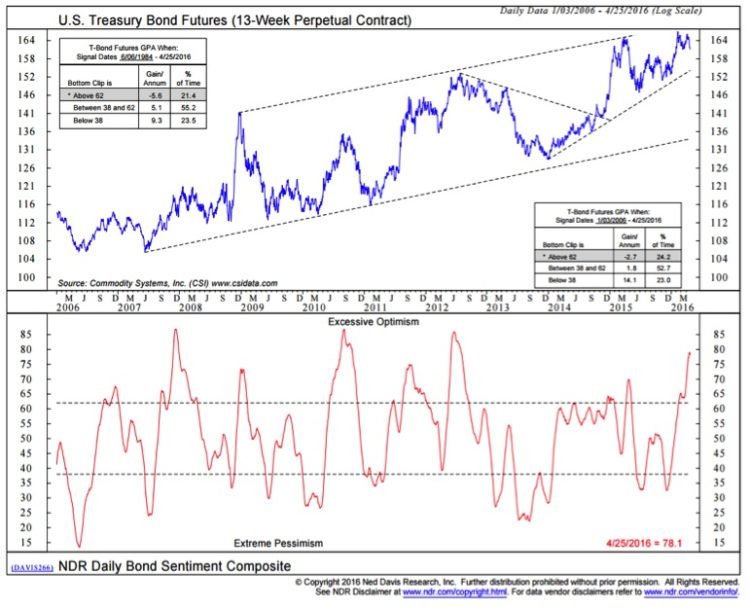

For the 10 year Treasury Note yield, the first quarter of 2016 seemed to follow the script from 2015 – an early-year swoon which was successfully re-tested, followed by a yield rally up to down-trend resistance. The rise off the low in 2016 has been more muted, however, as optimism in bonds has stayed elevated and dollars have continued to flow into bond funds.

While the yield on the 10 year Treasury in 2016 fully re-tested the 2015 lows, the yield on the 20 year Treasury in 2016 has stayed well above its 2015 lows. It is too early to suggest that a sustainable long-term up-trend in bond yields is emerging, but the down-trend is being tested, especially at the long-end of the curve. A break above 2.0% for the 10 year Treasury Note yield could see a quick test of 2.3% — a level that would have seemed inconceivable for many investors even a few weeks ago.

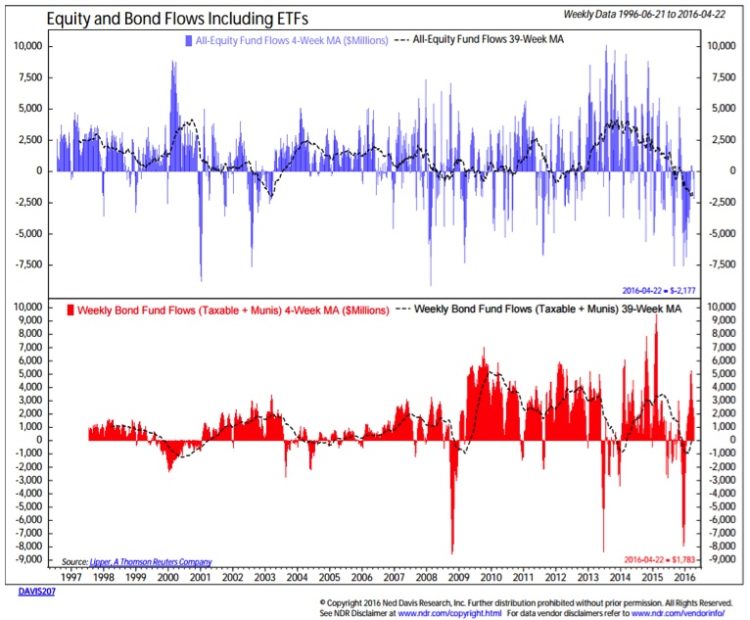

Fund flow data for stocks seem to attract most of the attention on a week-to-week basis. Whether the outflows from equity funds are part of a secular shift or evidence of investor skepticism is hotly debated. Bond fund flows seem to tell a more straight forward story. Large outflows at the end of 2015 (as the Federal Reserve started to raise interest rates and talk of more hikes in 2016) have been replaced by strong inflows in 2016. This demand has helped keep overall bond yields low even as recession fears have waned and stocks have rallied.

Bond sentiment (as measured by this composite indicator from Ned Davis Research) reflects what is seen from a fund flow perspective. Pessimism in late 2015 has been replaced with excessive optimism in 2016. In fact, bond market optimism is at its highest level since 2012. Bonds have historically struggled to add to gains when optimism has been this high and since bond yields move inverse to prices, this suggests the risk a meaningful move higher in bond yields. If the recent inflows for bonds turn to outflows, this could put additional upward pressure on bond yields.

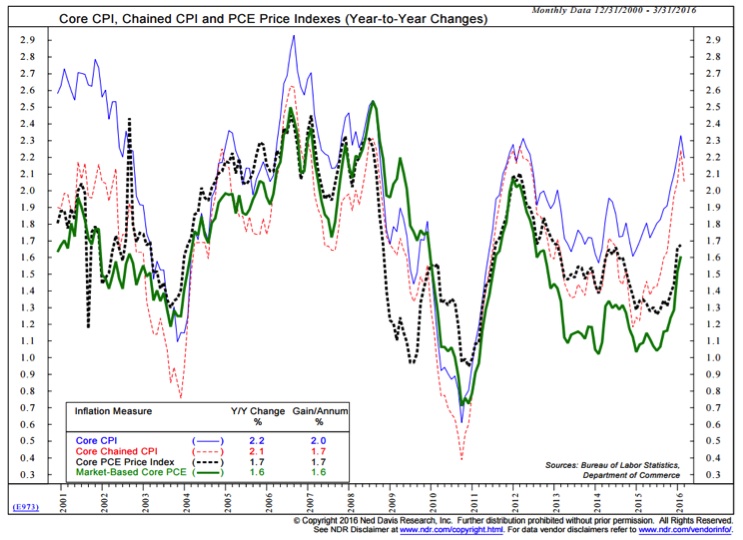

Beyond the technical factors, there are some fundamental drivers for higher bond yields as well. Bond yields are historically driven by three main factors: inflation, short-term rates, and international bond yields. Inflation is starting to move higher, the Fed continues to signal a more aggressive pace of rate hikes than the market has currently priced in, and international bond yields have moved off of their recent lows. A near-term improvement in economic data could push bond yields higher, as could continued weakness in the dollar.

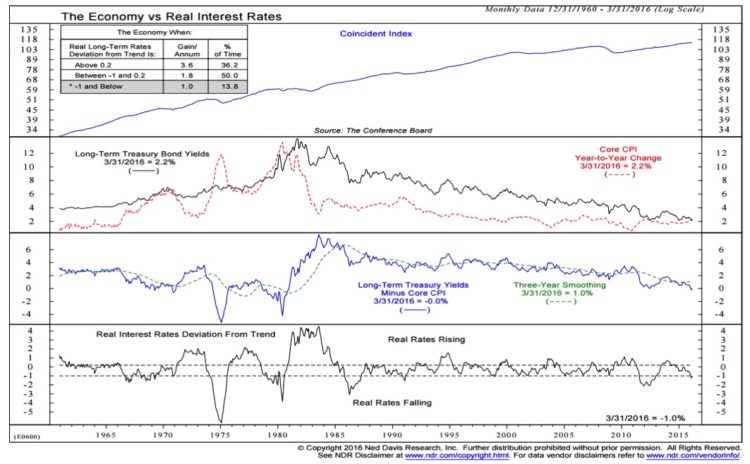

We need to be careful with correlation versus causation arguments, but it seems to be an unappreciated fact that economic growth has been more robust in periods when real bond yields have been above trend. In other words, while higher bond yields might not cause economic growth to accelerate, a sustained rise in yields may reflect an economy that is finally poised to see above average growth. Given the path we have traveled in recent years that could be a welcome development.

Thanks for reading.

Further Reading: Market Update: Stocks Hitting New Highs Expanding

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.