The following article is a part of Samantha LaDuc’s Gone Fishing Newsletter that she provides to fishing club members each week via email to identify macro inflection points and actionable micro trade set-ups.

As we awoke last Friday the 23rd of August to China imposing tariffs on $75B of US imports (right before Fed Chairman Powell stated at Jackson Hole that the Federal Reserve will do what it needs in order to sustain the expansion), I noted a sudden sell-off in the USD/JPY …

JUST BEFORE Trump ordered US companies to relocate from China and stop doing business with them.

That is one of the reasons I decided to press shorts intraday and said as such in my live trading room.

Trump went on to badger Powell in a nasty-gram of a tweet:

“Who is our bigger enemy, Jay Powell or Chairman Xi?” – President Trump.

While he ended the day by pronouncing an increase in tariffs on China, he also went on to agree to a trade deal “in principle” with Japan Sunday during the G7 meetings.

The critical $105 level in USD/JPY was in fact defended Sunday and since then markets, and Yen, have chopped sideways. And until this range breaks, we have little enthusiasm one way or the other.

Yen Stays Bid With Gold

Despite Yen and markets chopping sideways since last Friday, Yuan is much weaker and coincidentally Gold/Silver/Miners continue to get bid. In my DailyFX podcast, I gave my case for Gold June 6th. It is still in play for a whole host of reasons, but event risk is a big one. A strong Yuan devaluation, like we had in August 2105, is just one of them. This time the Yuan weakening is being fixed slowly versus all at once and in direct proportion to Trump’s Trade Tariffs.

I also went out on a limb back in early June to also say that I saw the Yen escaping BOJ control and heading higher – likely to hit ‘escape velocity” sometime before end of year:

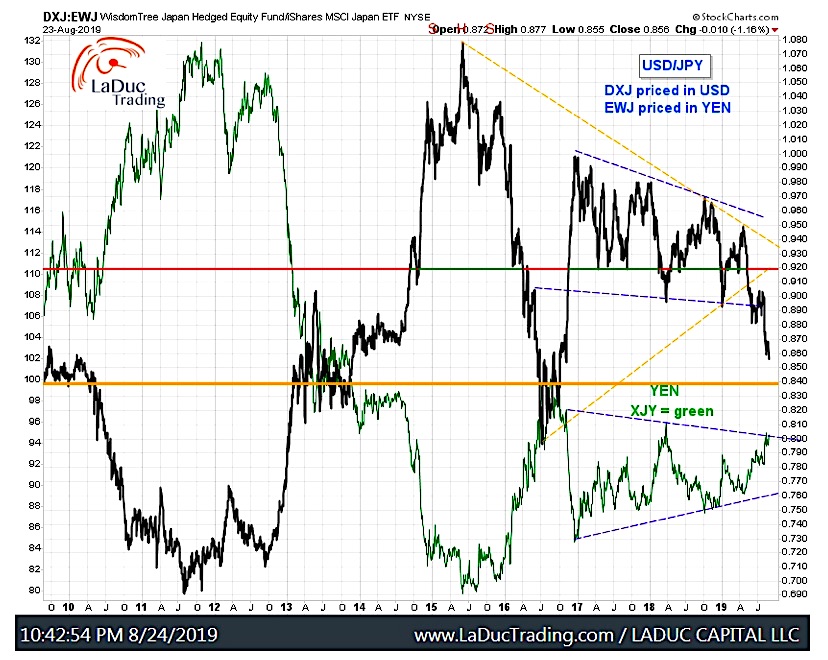

“I have a thesis – way early – that the currency market is going to have a surprise this year … with a break out in JPY. Not only is Yen at its strongest in two years, but my Intermarket DXJ:XYJ ratio work has broken a 3 year-long pattern – to the upside. In Forex land, that looks ominous for USDJPY breaking $108 and revisiting that flash-crash price near $105.”

We. Are. There.

Now What?

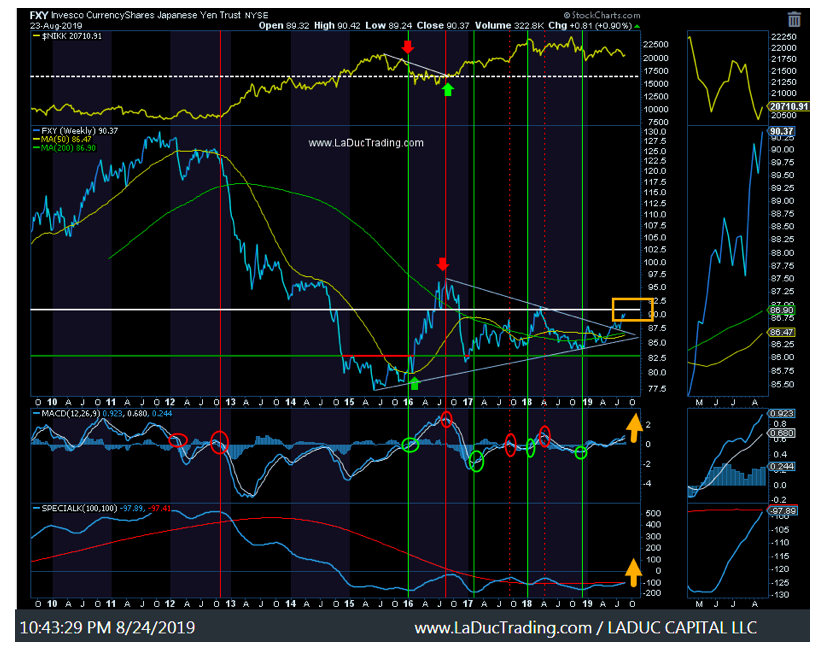

Here’s another look of what I mean by “Yen Nearing Escape Velocity”. This is the chart of FXY (Japanese Yen ETF) which I posted August 3rd to demonstrate the launch potential at ~$91, and as an effort to time Nikkei pullbacks (since it tracks inversely to JPY). Not much has changed in the past month and the Yen is still intonating bullish.

The Nikkei falling below it’s 200D around $20,000 (yellow circle), would trigger a further currency rotation into safety play Yen and support my thesis. A drop of USDJPY past $104.64 would likely trigger the market risk-off behavior for Nikkei and negatively impact US Equities.

Here was an update last month of the USD/JPY as it broke down (Yen breaking up) right after Trump raised Tariffs post FOMC meeting July 31st. It has continued with the direction of the breakouts throughout August.

With Trade Wars escalating, I have stated I fully expected USD/CNH to trade higher, Yuan lower as China retaliates/balances to offset effect from increased US tariffs. But real fireworks happen when USD/JPY breaks lower (through $105) sending the *pegged* “Yen Into Escape Velocity Mode”.

The Big Picture:

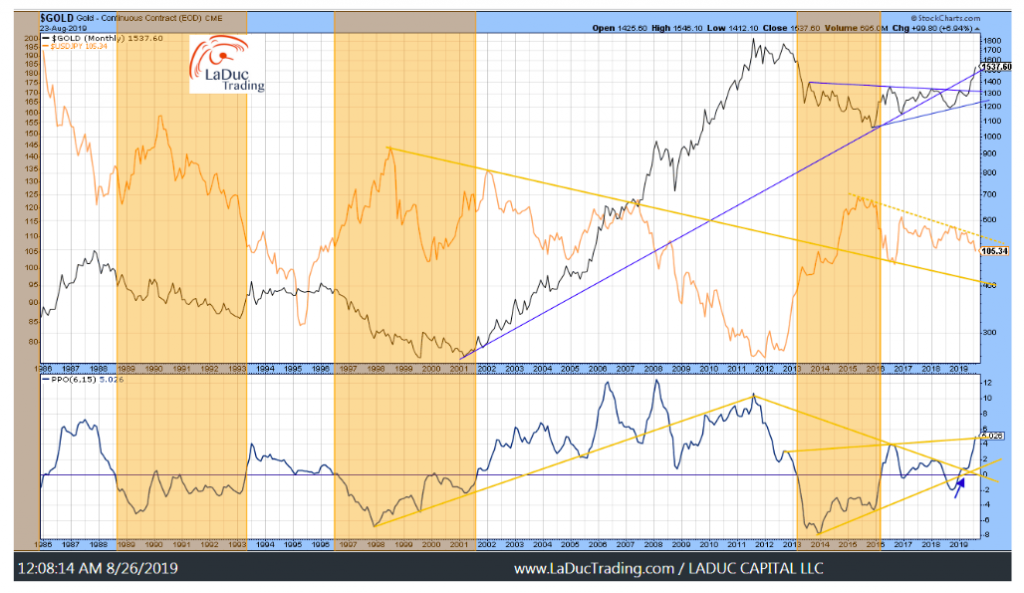

Here’s the Monthly chart of Gold and USD/JPY to show their relationship more closely. I included it in my Notes as part of my June 6 podcast for DailyFX and again updated for SeeItMarket this August.

“During the last 2 rate cut cycles, it paid to buy Gold and Silver after the first rate cut. See chart wherein the Fed cut nominal rates in late 2007 causing real interest rates (yields on 3-month Treasury bills less CPI inflation) to fall, which caused a strong run in Gold for first half of 2008 before strongly pulling back and then relaunching in 2009 for a multi-year run.”

I believe Gold is following a similar playbook, and so too will the Yen.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.