One of my favorite traders to follow on Twitter is @LMT978.

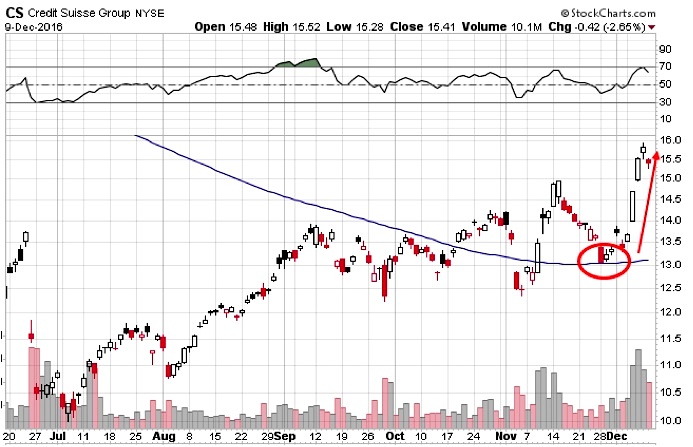

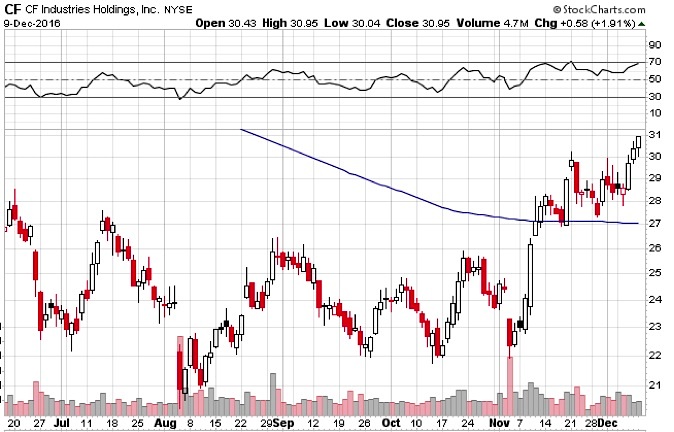

Recently, he has shared some great charts on stocks like Credit Suisse (CS) which was +15% for the week. A couple of other charts posted recently include CF Industries (CF) and the iShares Italy ETF (EWI).

Who would want to be long Italian shares you might ask?? But, the thesis is pretty simple. It has cleared the 200-day moving average and that generally allows fund managers to put a stock or ETF back on their buy list, or at least their watch list.

Another of my other favorite follows on Twitter is fellow See It Market contributor, @SJospehBurns. He has a saying that “Bad things happen below the 200-day moving average”.

It’s also true that the opposite can happen. Once a stock breaks back above the 200, it’s like the stock gets the “all clear”.

An even better signal is when the stock breaks above, pulls back and successfully retests the 200. This is exactly what Credit Suisse stock did in late November. Take a look what happened next.

Now, let’s take a look a the trading chart of CF Industries stock (CF).

Here we see another break of the 200 day moving average and a successful retest before a nice 10% rally.

The Italy ETF (EWI) has just broken through the 200 day moving average after having trouble earlier in the year. A high risk / reward trade might be to wait for a test of the 200, then go long. A stop loss could be set a couple of percentage points below the 200.

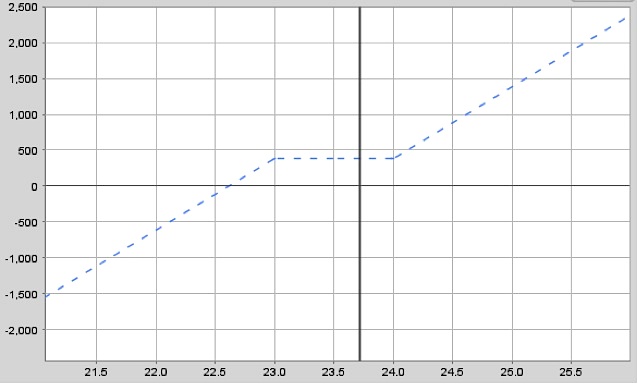

You could also trade the Italian ETF (EWI) with options. The beauty of options is you have so many different ways you can trade your viewpoint. You can trade conservatively or aggressively. Short-term or long-term.

Long calls would have a defined risk and unlimited upside if that was your preference.

Cash secured puts would be a way to gain ownership of the ETF at a reduced price.

A risk reversal is another trade that would do well if EWI rises. A trader would buy a call option and then pay for that call by selling a put. Here’s what a risk reversal in EWI could potentially look like.

Options provide a huge amount of flexibility and can be a valuable tool for traders and investors alike. You can learn more about strategies like this over at my site Options Trading IQ.

Twitter: @OptiontradinIQ

The author has a position in CS at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.