One of my favorite indicators could be flashing a major buy signal here. I’ve used the 21-day moving average of the CBOE options equity put call ratio a lot the past few months and it has done a good job of predicting things. Here’s why it could now be sending a bullish signal.

One of my favorite indicators could be flashing a major buy signal here. I’ve used the 21-day moving average of the CBOE options equity put call ratio a lot the past few months and it has done a good job of predicting things. Here’s why it could now be sending a bullish signal.

First off, to keep this simple, when this equity put call ratio trends lower – it has tended to be bullish for the S&P 500 (SPX). Think of it like this, when everyone is bearish and the equity put call ratio is high, this is potential buying pressure once those bearish bets are unwound. Once this happens, the ratio can move lower and with it we have a higher SPX. The flipside is once it gets extremely low, everyone is a little too bullish.

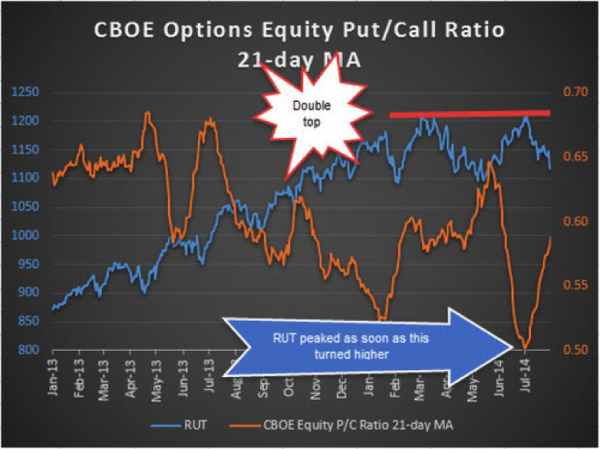

In the middle of July, I noted on Yahoo Finance that the equity put call ratio was extremely low (so option players were complacent) and turning higher (which historically had been bearish). These were warnings signs. Sure enough, the S&P 500 pulled back 4% and small caps did even worse. Here’s the chart I used back then.

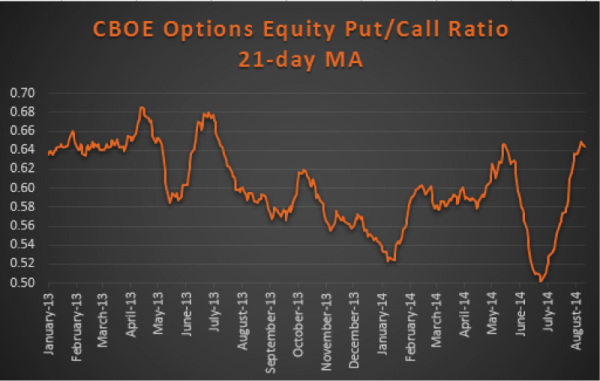

Here’s an updated chart from August 1. Again, the higher trending ratio predicted equity weakness.

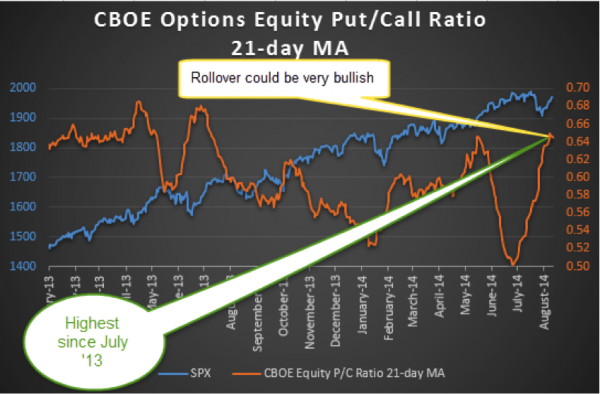

So what’s it look like now you ask? It recently reached its highest point since July ’13 and is potentially starting to roll over. Remember, it could be ‘high’ or ‘low’ but that doesn’t matter as much as the overall trend. Rollovers from extremes (like now) are what I’m looking for.

Here’s the fully updated chart with the S&P 500 (SPX) included.

To me, should this continue to roll-over it has a long ways to potentially fall. In other words, there are some significant buyers still out there.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.