International Business Machines (IBM) has been a tough stock to own for longer term investors. Over the past three years, IBM stock has fallen from $215 to as low as $140 this year. This has tested patience while investors remain hopeful that IBM can reinvent itself with a focus on growing their cloud and data/analytics businesses.

On Monday October 19th, after the close, IBM will announce earnings for last quarter. The developing rally in IBM stock will likely bring more attention to the upcoming IBM earning report.

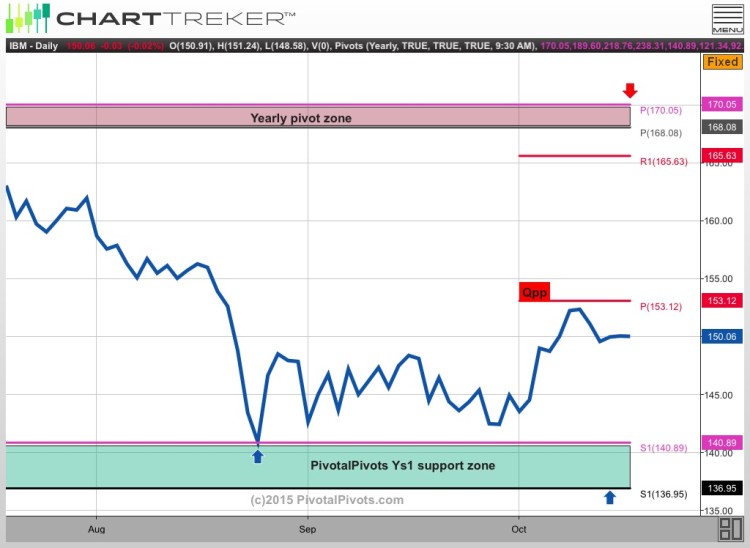

IBM’s stock price has made a short-term (possibly long term) bottom on the YearlyS1 pivot. The ensuing price action out of IBM earnings will be important.

That’s where the “smart money/big banks/Institutional traders” covered shorts. If IBM’s stock price can get above the Quarterly Pivot at $153, I see it going back up to the Yearly pivot point at $170 by the end of this year. $137-$140 should be the low for this year, however I still have a worst case scenario at the Demark Yearly Low pivot around $131. Those are key levels for stops, depending on risk tolerance and time frame.

IBM Stock Chart – Watch those pivots!

Thanks for reading and have a great weekend.

Twitter: @mpgtrader

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.