Gold has been mired in a multi-month down-trend. The move from intraday high to low comes in at a roughly 20 percent decline.

Gold bulls are obviously hoping that the recent low will hold and that a new bull market move will emerge.

While the recent price action is encouraging, there is still work to be done before an all clear signal.

Today’s chart takes a broad, simplified technical look at the Gold ETF (GLD) – see further below. Therein, I highlight several reference points that assist active investors in understanding the price trend and construction on a given time frame.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

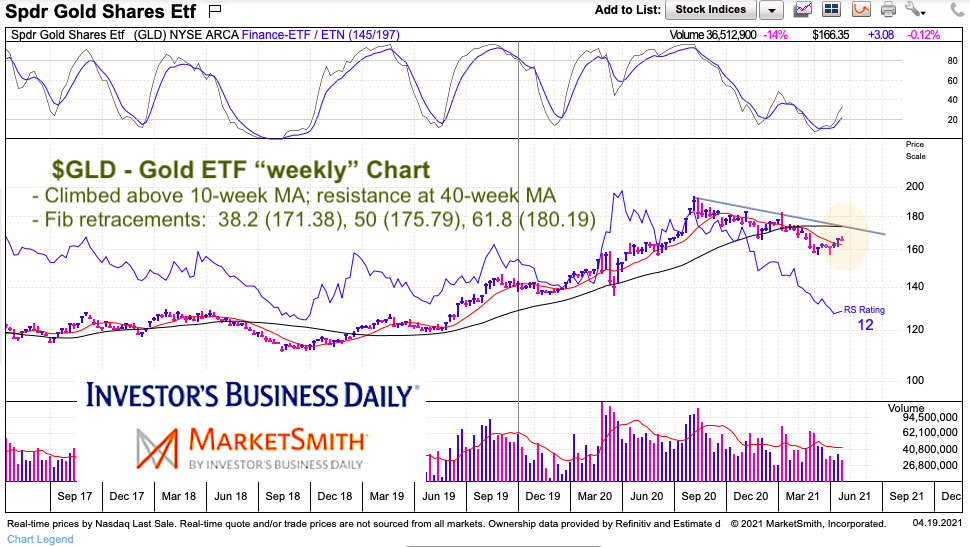

$GLD Gold ETF “weekly” Chart

The “weekly” chart is an intermediate-term timeframe. It can help “trend” investors, looking to catch a move for weeks to months. As you can see, GLD has been in a down-trend for several weeks. The recent price action has seen GLD climb back above its 10-week MA (red line) and momentum turn up. This is constructive for bulls. The 10-week MA and recent lows serve as two price support levels. A return below the 10-week MA on a weekly close would be concerning, and a move below recent lows bearish.

Should Gold continue to move higher, our resistance reference points are pretty clear. $171.38 is the 38.2 Fibonacci retracement. A move over this level would be a further notch in the belt for bulls. But the big level is around $175/$176; this consists of a confluence of resistance, including the down-trend line and 40-week moving average. That will be a battleground and likely determine if this move has legs.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.