Last week’s news on the vaccine front provides encouragement that the fight against COVID will be won (and perhaps sooner than later). News out of DC that fiscal stimulus talks have resumed is also a positive development (though until a deal actually passes the President’s desk, this might be all hat, no cattle).

These headlines come at a critical time as we remain in a challenging time from both a health and economic perspective.

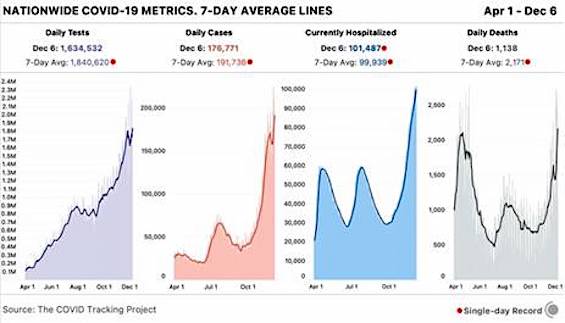

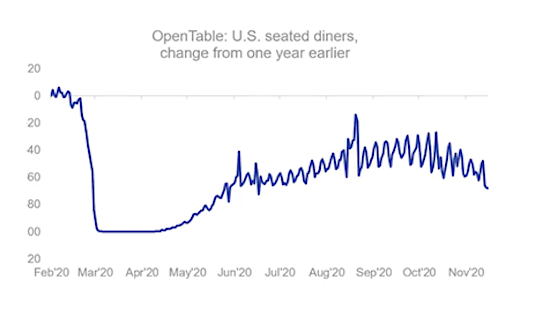

COVID metrics just hit new highs on a 7-day basis and the economy is showing signs of slowing. Consumer spending growth is stalling, job growth in October fell well short of expectations and data from OpenTable on in-person dining (which was the indicator du jour for many over the summer) has turned lower as temperatures have cooled. While there may be real hope on the horizon, the near-term challenges are intensifying, not waning.

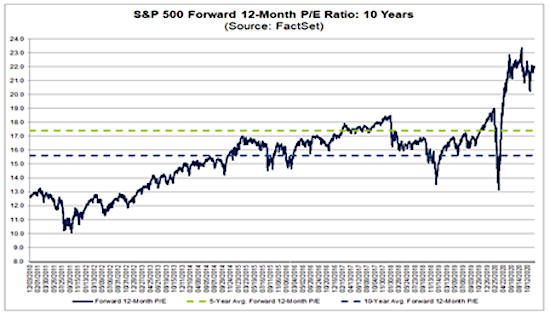

These Main Street challenges are real, but for now Wall Street is looking past them. Data from FactSet shows investors are placing a premium valuation on forward earnings, with the forward P/E ratio well above its 5-year and 10-year average. In fact, the forward P/E ratio is at a level last seen in 1999/2000. While I don’t really agree with either, I can take more seriously those who argue that fundamentals don’t matter for the market right here than those who make the claim that fundamentals are justifying the recent price action.

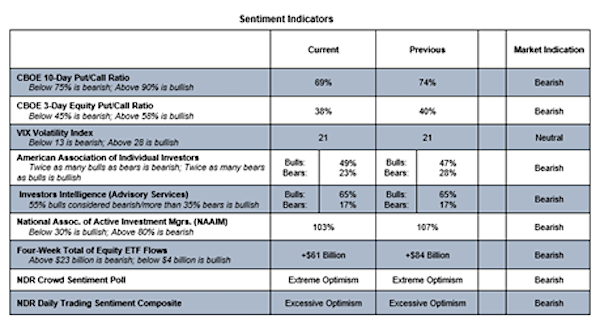

Investor sentiment remains a primary near-term risk for stocks. Rarely have the sentiment indicators across options activity, weekly surveys and fund flows pointed to such unanimity of optimism. While the crowd is clearly at an optimism extreme, damage to stocks does not typically occur until this begins to reverse. With the market seemingly looking past near-term health & economic challenges and priced for a rosy growth scenario in 2021 and beyond, there are ample tripping hazards that could upset the proverbial apple cart.

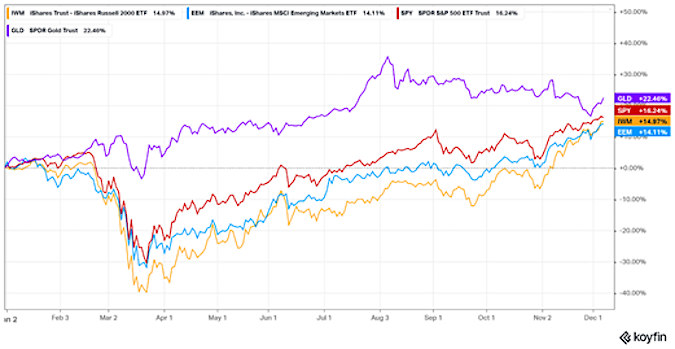

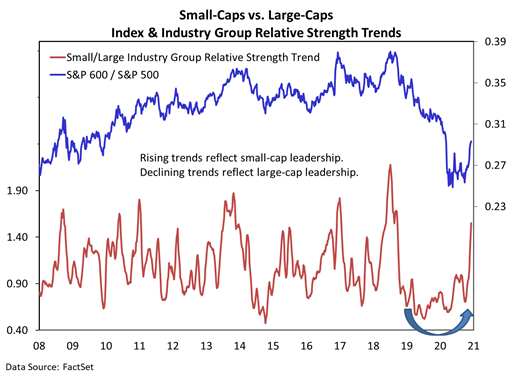

While sentiment provides a near-term challenge and stocks have perhaps come too far too fast since their early 2020 lows, a longer-term perspective shows many areas of the market (especially outside of mega-cap Tech names) just now emerging from a two-year-old bull market. A notable focus remains small-caps and Emerging Markets, both of which appear poised to sustain leadership in 2021. In fact, leadership here may not even wait until next year. Small-caps trail large-caps by only about one percentage point on a year-to-date return basis, and emerging markets are only one percentage point behind them. It would not surprise me if either (or both) surpassed the S&P 500 before the end of this year. Overtaking gold, however, does not seem likely. Recent leadership by small-caps has been anticipated by improving trends at the industry group level and that rotation remains ongoing.

I had a chance to discuss any of these trends and developments on the TD Ameritrade Network last week. You can see that complete interview here.

The Bottom Line: Stocks have priced in a robust recovery and investors are almost universally optimistic. Benefits of diversification (declared dead by some earlier this year) are returning as stock market leadership has shifted toward small-caps and emerging markets. A financial plan that has no provision for following this strength could be hard to adhere to going forward.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.