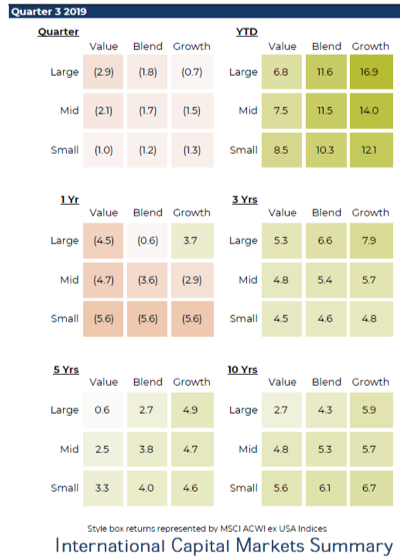

Most of us all familiar with the Morningstar Equity Style Box that measures performance among the 9 ‘styles’ from Small Cap Value in the lower left to Large Cap Growth in the top right.

It is no surprise that growth stocks have crushed their value counterparts over the last 1, 3, 5 & 10-year periods for the most part.

Being a proponent of the global equity market portfolio, I was constantly on the lookout for the non-US Equity Style Box.

I even tweeted to Morningstar several times requesting it, but to no avail. Luckily, my 457(b) plan provider at work has it in their quarterly update.

I serve on the retirement plan committee, so I have access to such documents.

Below is the international (ex-US) Equity Style Box. For a data nerd like me, I salivate when I see something like this.

Not surprisingly, some of the similar themes emerge when looking beyond our borders, but I was surprised to see value holding in their fairly well. US value stocks have just taken it on the chin for quite some time now.

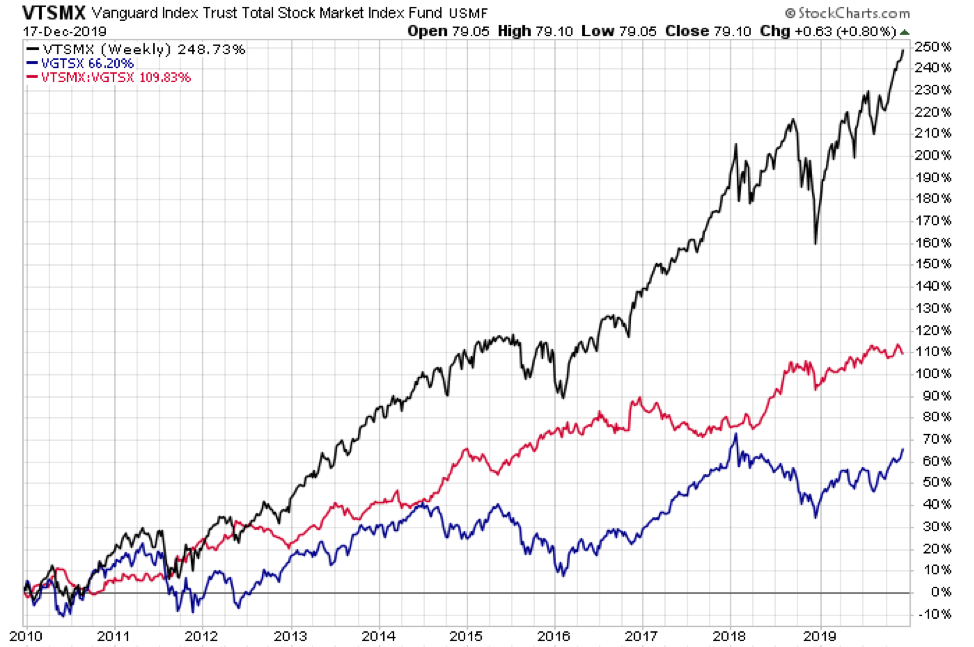

What is also interesting is how poor the returns have been internationally relative to US stocks. By now, I’m sure we all generally know this. But I do find it interesting how some investors feel secure from a risk management perspective with heavy US exposure using the tagline of ‘well, my US stocks do business overseas, so I’ll get my global exposure that way’. The problem with that is the data.

That justification, to me, implies that returns between US equities and non-US equities should not differ much (since US stocks do business in overseas markets and non-US stocks generally have some sales in the US).

Returns over the last 10 years show a stark ‘alligator jaws’ pattern. When will the jaws close? Will they even close? I don’t know, but historically there has been some mean-reversion in this arena.

I am a Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT). I have passed the coursework for the Certified Financial Planner (CFP) program. I look to leverage my skills in an hourly-fee consultant role for financial advisors – that could be portfolio analysis, planning, writing etc. Please reach out to me at mikeczaccardi@gmail.com for more information. Connect on Linkedin.

Twitter: @MikeZaccardi

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.