Welcome to Thanksgiving week in the year 2020. The TSA is reporting that more than one million passengers across the country passed through TSA checkpoints on Sunday – that is the most since the beginning of the pandemic. Conditions, though, are still far from normal as we figure out how to celebrate another holiday in these unique times.

Personally, in any other year I’d be preparing for a frantic cross-country road trip (from Milwaukee to Washington DC and back), figuring out how far we could travel in a given day and whether we would be driving through lake-effect snow as we drive south along the Great Lakes.

BUT, because it is 2020, we will be counting our blessings (of which there is no shortage) locally and hope that others are able to do that as well.

From a stock market perspective, stocks are in a seasonally strong period, both this week of Thanksgiving and the trend into year-end. However, these historical tendencies are well known and have been widely discussed. This brings to mind the quote from Bernard Baruch:

“Something that everyone knows isn’t worth anything.”

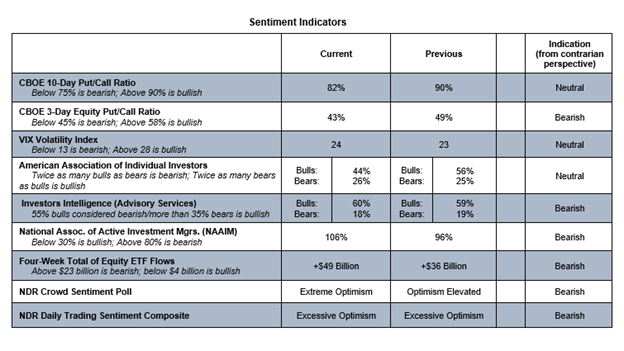

Investor sentiment data suggests investors are overwhelmingly positioned for stock market strength. Options data reflects complacency, surveys show optimism, and flow data show investors moving into equity funds in a dramatic fashion. Nearly $50 billion has flowed into equity ETF’s over the past 4 weeks. That is the most since February 2018.

I don’t like to spend too much time thinking about short-term movements in the market, and one of the things I’ve learned by looking at the Monet are the Milwaukee Art Museum is that too much focus on details can obscure perspective and keep us from appreciating the big picture. Still, with everyone looking higher, it may be worthwhile to consider a contrarian view.

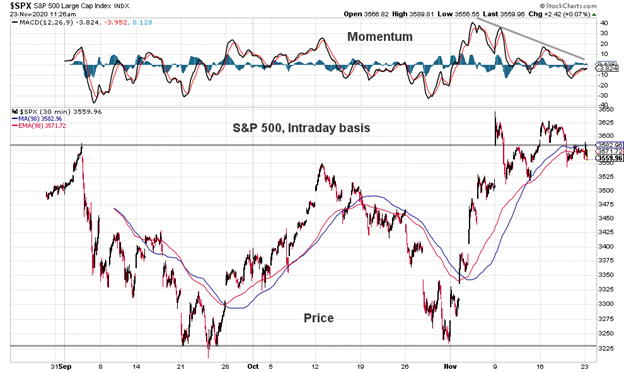

A short-term chart of the S&P 500 shows momentum stalling and the longer the index remains below its September peak, the more likely it is to re-test the September and October lows. Such a scenario could help unwind optimism and confirm the recent strength in the broad market and leadership from small-caps and mid-caps (which have continued to hit new highs even as the S&P 500 has moved sideways).

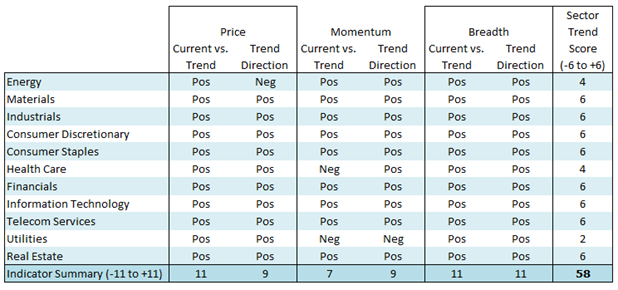

Relieving near-term optimism would help return the focus to the tension between the bullish message coming from broad rally participation and the bearish message stemming from valuations. Breadth thrusts provide an encouraging tailwind, though the spike in the percentage of stocks & indexes trading above their 200-day averages could be near-term climactic (that has been the pattern in recent years). From a valuation perspective, stocks are historically expensive, but the relevant questions is knowing when Keynes (“the market can stay irrational longer than you can stay solvent”) yields to Stein (“If something cannot go on forever, it will stop”).

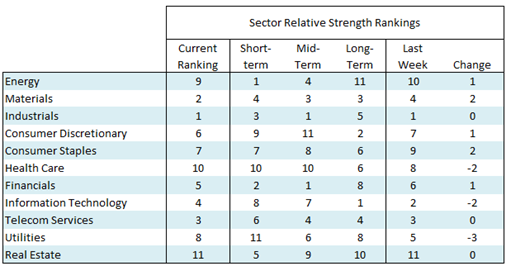

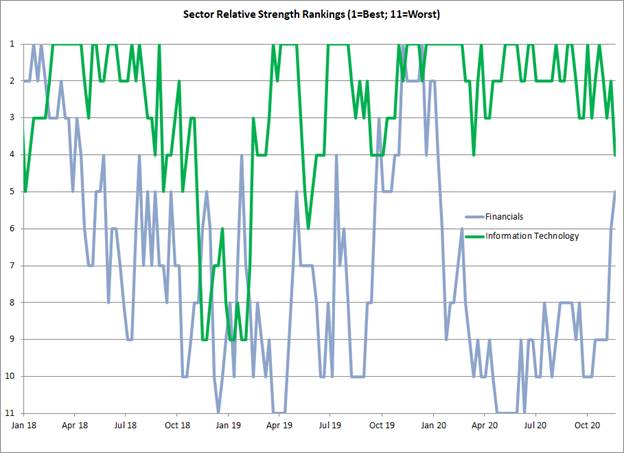

Sector level trends remain strong and leadership shifts remain ongoing. Industrials and Materials are the top-ranked sectors in our relative strength rankings. Technology is rolling over after an extended period of relative strength while Financials are heating up after an extended period of relative weakness.

The Bottom Line: Near-term consolidation would help provide a healthy re-set for the stock market. A pullback could test the durability of recent leadership rotations. I expect any such tests to be successful and would use volatility to increase shift toward smaller cap and more cyclical equity exposure.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.