Last year, I worked with a doll-maker to create these dolls that represent the diverse and important sectors of the U.S. Economy.

She took the cartoon image you see on the bottom of the photo, and went to work.

I now have six amazing characterizations of the economy that stand approximately 18 inches tall.

From left to right: Sister Semiconductors – Sector ETF (SMH), Prodigal Son Regional Banks – Sector ETF (KRE), Granddad Russell 2000 – Index ETF (IWM), Granny Retail – Sector ETF (XRT), Tran Transportation – Sector ETF (IYT), and Big Brother Biotechnology – Sector ETF (IBB).

Stanley Drucknemiller, uses three primary sectors to determine econmic cycles: Housing, auto sales, and big-ticket or durable goods consumption.

IYT, IWM and XRT incorporate auto sales, and big-ticket or durable goods consumption.

Housing is not a character yet. However, the Family always welcomes its aunts, uncles and cousins.

Housing is not a character yet. However, the Family always welcomes its aunts, uncles and cousins.

The reason I bring up Drukenmiller, is that he also uses bank stocks (XLF), retail stocks (XRT) and small cap stocks (IWM) as economically sensitive sectors.

So not a perfect match without housing, but reliable indicators, nonetheless.

While I may not be Druckenmiller, I do find that the years I’ve used my economic family, I’ve have been able to accurately see and advise on the inflection points in both the economy and the market.

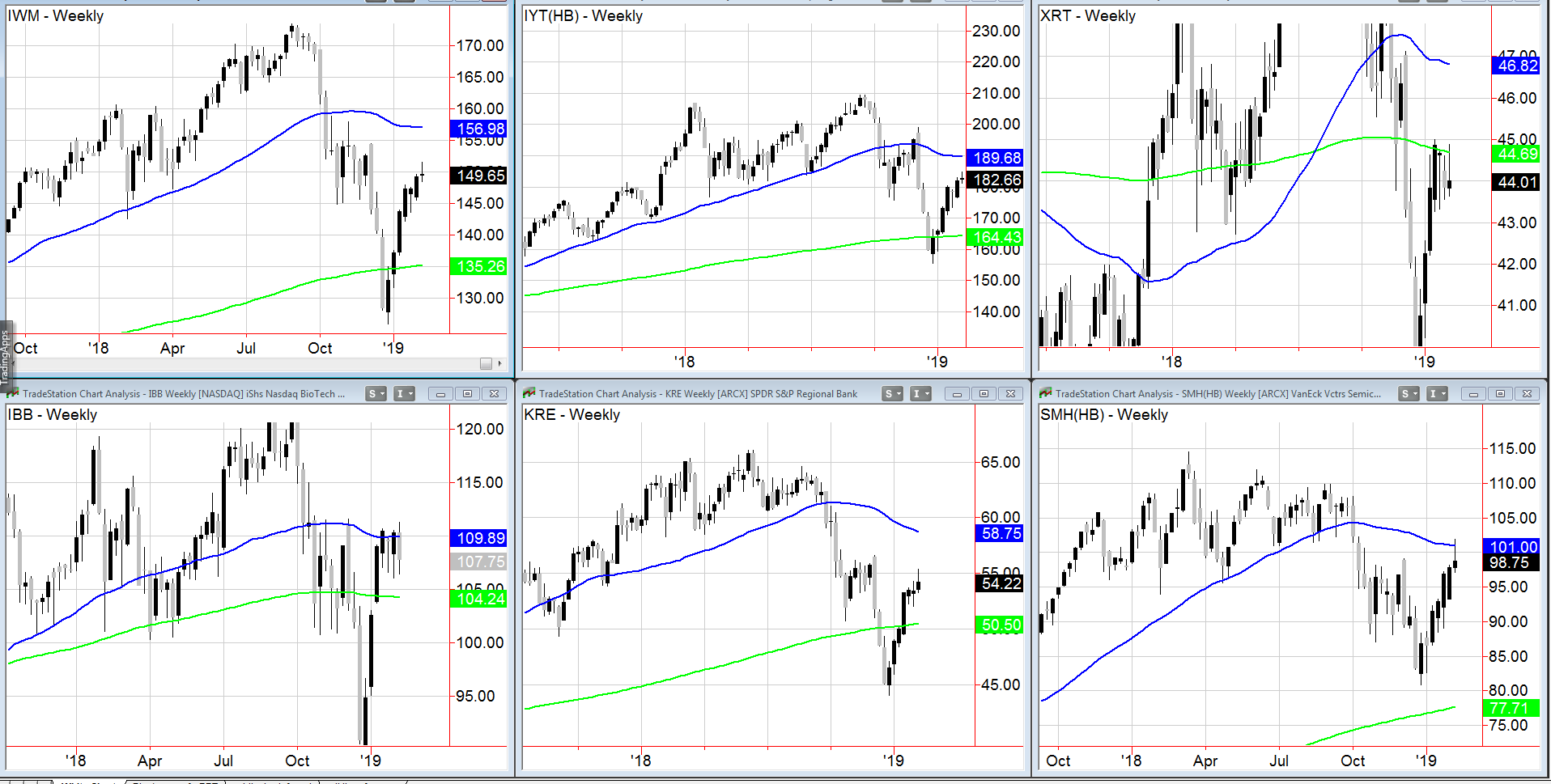

Let’s take a look at their weekly charts.

Top left is the Russell 2000. IWM remains in a recuperation phase on the daily chart (above the 50-DMA) and a caution phase on the weekly (below the 50-WMA).

That leaves little in the way of clues as to whether the sell off was a healthy pullback or the start of a new leg down.

Next is IYT. It closed red on Friday, but above the daily chart support. On the weekly, it also leaves little clues.

Then there is Retail. Still very much the weakest as it has a declining slope on the 200-WMA (green). XRT is in a distribution phase. Druckenmiller would be concerned, as it not only shows vulnerability in that sector, but also for the entire economy.

Next row is Biotechnology. This week, it failed the 50-WMA (blue) so it is back to a caution phase from a bullish one. Besides the political factor in this sector, it indicates a waning of speculative confidence.

The middle bottom chart is Regional Banks KRE. I’ve been writing about 55 as key resistance. This is also in a caution phase and merits close attention as confirmed by Drukenmiller having a similar focus.

Finally, Semiconductors, the current market leader, could not close above the 50-WMA. Should SMH remain weak, and unable to clear 101.00, then take that as yet another warning.

With the charts stuck between phases on the weekly charts, but still holding positive phases on the Daily, we begin next week with an air of caution, ready to pounce either way once the next direction elucidates.

S&P 500 (SPY) – Got the weekly close over 269 to keep the bulls in the game. Under 266.24 will embolden the bears. A close over 272.58 will excite the bulls. Subscribers: Negative Pivots in all

Russell 2000 (IWM) – Inside day. A move under 147.95 not so healthy. Above 152.40 a miracle. In between, I’d use 150 as pivotal.

Dow Jones Industrials (DIA) – Got the weekly close over 248.96 to keep the bulls in the game. Under 246.47 will embolden the bears. A close over 254.35 will excite the bulls as we are above the 200-DMA but working a reversal topping pattern.

Nasdaq (QQQ) – Got the weekly close over 166.68 to keep the bulls in the game. Under 165.29 will embolden the bears. A close over 170.14 will excite the bulls.

KRE (Regional Banks) – Looking at 53.18 to hold if good and 55 the next viable resistance

SMH (Semiconductors) – 101 key resistance and 97.24 the key underlying support

IYT (Transportation) – 180.85 support held and 185.37 weekly resistance to clear.

IBB (Biotechnology) – 109.92 the 50-WMA resistance. 107 the weekly support held.

XRT (Retail) – 44.60 pivotal for the week. 43.50 the must hold spot

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.