The carnage in banking stocks of developed countries in Europe has been a persistent theme throughout the last year. The combination of adverse economic progress coupled with negative interest rates in many developed countries has wreaked havoc with European financial institutions such as Credit Suisse Group (CS) and Deutsche Bank AG (DB).

One little-known exchange-traded fund that tracks this group is the iShares MSCI European Financials ETF (EUFN). This ETF has $194 million dedicated to a group of 100 European stocks in the financial sector. Top country allocations include the United Kingdom, France, Switzerland, and Germany.

EUFN is down -23.89% over the last year versus a decline of -11.89% in the broad-based iShares MSCI EAFE ETF (EFA). Clearly this sector has been a serial underperformer and weighed heavily on the performance of more diversified international indexes.

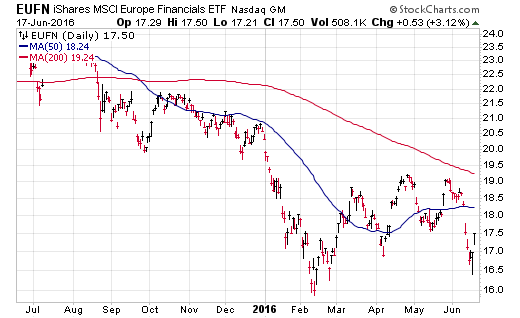

Looking at a chart of EUFN below, it can be conceived that these European financial stocks are attempting to stabilize. A higher low versus the February bottom would be constructive. On the flip side, a break below the February lows could potentially drag Europe and other broad-based international stock market indexes lower as concerns over wider financial issues take hold.

This European Financials ETF has appeared to ride a rollercoaster of price action over the last four months. It will be an important index to watch through the summer months as the referendum for the United Kingdom exiting the European Union takes place. Financial and banking stocks in the U.K. make up nearly one-third of the portfolio holdings in EUFN.

Furthermore, the spread of negative interest rates will be an important driver of the price action in bank stocks as well. Charlie Bilello, Director of Research at Pension Partners, posted the following table via Twitter on June 16th that references the current state of government bond yields around the world.

Negative Yields through…

Swiss: 30 yrs

Japan: 15 yrs

Germany: 10 yrs

Austria: 8 yrs

France: 7 yrs

Ireland: 4 yrs pic.twitter.com/KouMfH0VPB— Charlie Bilello, CMT (@MktOutperform) June 16, 2016

In my estimation, the price action of European banks is one to watch right now and can be easily monitored through EUFN rather than having to identify many individual stocks. With Brexit around the corner, the European financials are a focal point.

Thanks for reading.

Twitter: @fabiancapital

The author of his clients may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.