The first three months of 2016 are in the books and about the only thing everyone can agree on is that, for financial markets everywhere, it was definitely a quarter full of drama and excitement.

The sharp drop in the US stock market at the start of the year had nearly everyone convinced that the long bull market was without a doubt dead. This conclusion was not far fetched as several stock market indices (i.e. small- and mid-cap) were firmly in bear market territory in January and other major indices seemed ready to follow suit.

Not surprisingly, the “doom and gloom” pundits were out in force with a few going out on a limb to claim that the world was in such dire straits there wouldn’t be another bull market “in [their] lifetime.”

The reasons for this depressing prognosis were many: oil was forecasted to go to $10 and lower, the Chinese house-of-cards economy would collapse and sink into the ocean, the wave of energy-led debt defaults would create a crisis rivaling 2008, yada, yada.

Amid all this pessimism, the US stock market quietly bottomed in the middle of February and then embarked on a furious rally in March as it became apparent that (once again) the world was in a much better shape than what the smart, sharply dressed man on your TV tried to make you believe.

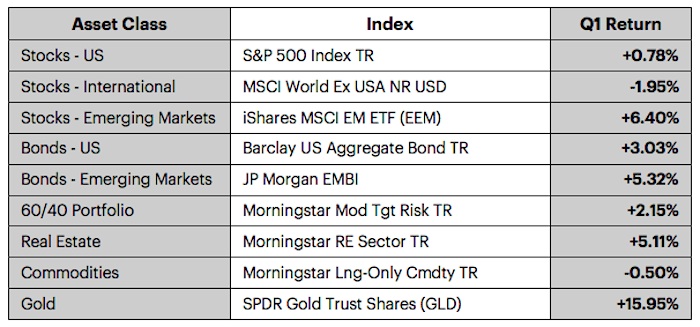

When the dust settled, the first quarter of 2016 turned out to be firmly positive for most asset classes, especially gold.

As an aside, the most important takeaway from the above table in our opinion is that this quarter illustrated the value of proper portfolio diversification.

If you are like most American investors who think a well diversified portfolio is the one with 60% in US stocks and 40% in US Treasuries, you mostly missed out on the best performing asset classes: emerging market stocks and bonds, real estate, and natural resources.

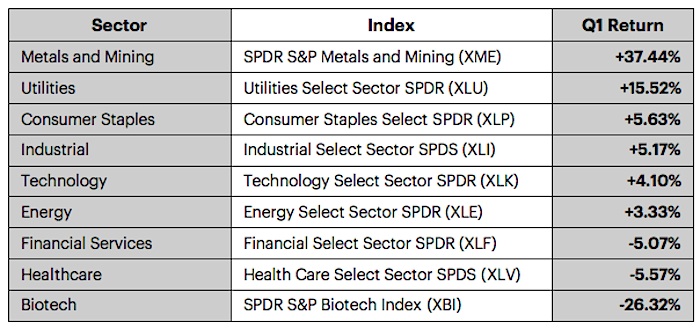

A look across major equity sectors also shows fairly broad strength.

Miners had an extremely strong quarter, dwarfing gold’s performance. Even more incredible is that this sector rallied more than +75%(!) from its bottom in mid-January.

This may not be so surprising if you remember that mining stocks lost about -85% over the course of the last five years. Given the cruel nature of arithmetic they have a long way to go: to get back to their highs, miners need to essentially quadruple from here.

The return to “risk on” mode in March did not seem to diminish the appetite for defensive sectors: Utilities and Consumer Staples finished the quarter as the leaders.

Bringing up the rear were healthcare and biotech sectors, which went down in January and were unable to get off the mat. This also should not be surprising if you remember that biotech stocks quadrupled in four years leading to July of last year.

Q2 and Beyond

The future remains murky and impossible to predict, at least for us humans.

Analysts and economists seem as divided as ever: some claim the US is already in a recession and the financial markets are headed for a bear market/crash later in the year. Keep in mind that every year brings calls for some kind of a crash of the US economy or markets, so it is hard to give these claims any credibility.

The more optimistic rightfully point to the fact that the US economy may be growing slowly, but it is continuing to grow and there are no indicators that currently point to a recession. Economists and their indicators are, of course, infamous for “predicting nine out of the last five recessions” or missing them altogether, so their claims also have to be taken with a grain of salt.

Recession and crash arguments aside, what cannot be ignored is that global central banks remain firm in their commitment to support equity markets. Market weakness in the opening months of 2016 was enough for the US Federal Reserve to take the interest rate hikes planned for 2016 off the table for the time being.

This had the (likely intended) consequence of halting the rally in the US dollar, which in turn resulted in a boost to global asset classes and corporate earnings for US multinationals.

This boost aside, US stock market valuations remain elevated relative to history, relative to foreign stocks, and especially relative to the slow growing domestic economy. This, in our opinion, will be the biggest obstacle to significant upside for the US stocks (and again reinforces the need for proper diversification).

Having said that, there are many instances of markets acting irrationally and contrary to expectations, fundamentals, or valuations.

What Should Investors Do?

If you find yourself confused by the above economic mumbo jumbo, do not fret. The good news is that your success as an investor does not depend on your ability to successfully predict the future.

The first three months of 2016 were a very good reminder of the importance of having an investment plan, ideally the one that includes a properly diversified portfolio mentioned above.

Even more important is your ability to stick to that plan and ignore short-term market fluctuations. Yes, we seem to endlessly drone on this point but we do it because we believe it to be so critical.

If you were able to do this through the gut-wrenching volatility of January and February then you should feel good about your prospects as an investor.

Thanks for reading.

Twitter: @KastelCapital

The author or his clients may hold positions in various securities that are mentioned in this article at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.