The international marketplace has been teeming with activity lately as Greece grapples with insolvency, the China stock bubble bursts, and peripheral nations feel a bit of falling commodity prices once again. This type of stuff makes international investing difficult.

The international marketplace has been teeming with activity lately as Greece grapples with insolvency, the China stock bubble bursts, and peripheral nations feel a bit of falling commodity prices once again. This type of stuff makes international investing difficult.

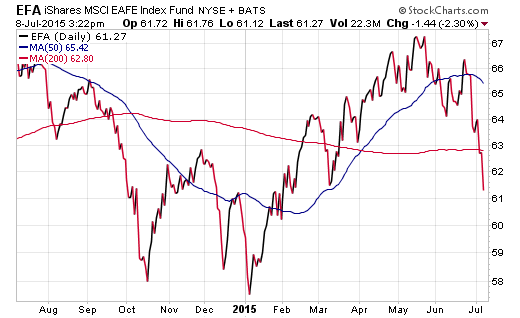

All of these headlines have severely eaten into the gains in many of the top single-country and international investing indexes that I follow on a regular basis. The largest international ETF is the iShares MSCI EAFE ETF (EFA), which has over $59 billion dedicated to 921 stocks of both developed and emerging market countries overseas.

EFA had gained as much as 12% when it peaked in May and has now given back a full 10% from the highs. This international index is now just slightly ahead of the SPDR S&P 500 ETF (SPY) on a year-to-date basis and has plunged through its long-term 200-day moving average just recently. For many international (and domestic) investors the 200 day moving average is a caution sign.

From a technical standpoint, EFA is now trading near a short-term low established last March and a reversal at these levels would ultimately setup for a high probability run back to the 200-day average or higher. Of course, it’s always worth noting that an extension of this drop has the potential for an additional 6% move down to the January lows.

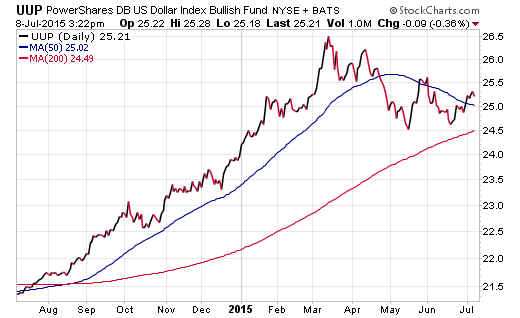

Another factor that has become a hot point of contention in the international investing game is the currency impact of the strong U.S. Dollar. The chart of the PowerShares U.S. Dollar Bullish Index (UUP) shows that the index is now coiling into a tighter range that could develop into another outsized move in either direction.

Those that believe the U.S. dollar is running out of steam should consider a more traditional international position such as EFA. Conversely, those that believe the U.S. dollar will move higher should choose a currency-hedged ETF that will combine long stock holdings with short currency exposure. The largest currency-hedged equivalent to EFA is the Deutsche X-trackers MSCI EAFE Hedged Equity ETF (DBEF), which has $12 billion in assets under management.

Ultimately, your game plan for international exposure should be governed by your existing asset allocation and risk tolerance. Those with a more conservative mindset may opt to stay on the sidelines at this time until the dust clears from the international investing landscape. While that may result in most lost opportunity in the event of a sharp rebound, it will also ensure that your capital is less susceptible to further declines if conditions worsen.

On the flip side, those with a more aggressive or trade-oriented mindset may opt to take advantage of this pullback by initiating new positions in areas of the globe that have fallen more significantly than U.S. markets. A fund such as EFA will offer very broad access to international stocks, yet other more focused international investing opportunities may develop in Asia, emerging markets, and even Europe as well.

The bottom line is that developing a sound game plan and implementing it decisively will produce superior results than simply watching the market pass you by.

Twitter: @fabiancapital

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.