One of the most important themes during the first half of 2022 is rising interest rates.

And with the Federal Reserve focused on stopping inflation, it’s a legitimate concern.

But is there also a case for falling interest rates in the back half of 2022? With several commodities pulling back and rates easing, perhaps we could see rates decline.

Well, it’s Friday so we need to turn to Joe Friday for “The facts, Ma’am. Just the facts.”

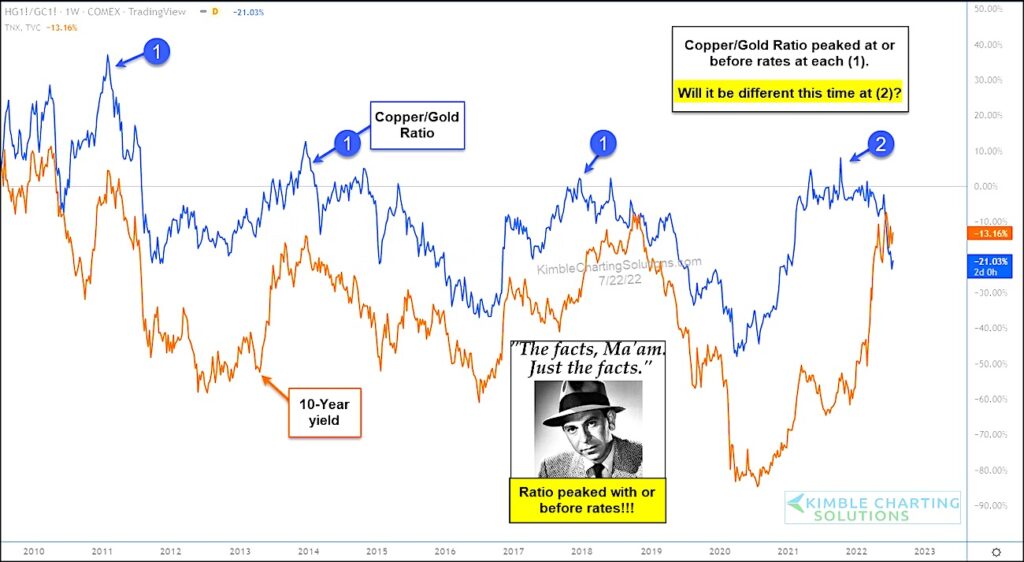

And this leads us to an important ratio chart: the Copper / Gold price ratio. This has been an important indicator for turns in interest rates. Here we pit this ratio against the 10 year treasury bond yield (interest rate).

As you can see, the Copper/Gold ratio has peaked prior to or with interest rates at each point (1).

Now look at the past 2 years. The ratio peaked at point (2) and interest rates are just now starting to pull back. Will this indicator work again? Or will it be different this time? Stay tuned!

Copper/Gold Ratio versus 10-Year Bond Yields Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.