The All Ordinaries Index has yet to hit its SELL pattern target so this pattern is still valid. The zone of 5760-5835 is the key with the old realiable .786 Fibonacci retracement up at 6060 the highest it should go if the sell pattern remains valid. As you know we NEVER know which one works or doesn’t…

What makes this particularly relevant, in my HUMBLED opinion is its correlation to the AUDJPY and the VERY interesting pattern that is appearing with regards to the AUDJPY. For a review of the charts, here is the pattern on the All Ordinaries:

Now here’s the importance of the AUDJPY currency pair and the All Ordinaries Index:

So we are nearing a sell pattern target on the All Ordinaries Index that (if elected) should cause the YEN to strengthen against the AUSSIE based on correlation… one percent opposite of the intervention!

As you well know, I know NOTHING about the fundamentals behind this move… but IF the All Ordinaries Index sell pattern works, then historically speaking the patterns and charts tell us the YEN will strengthen against the Aussie. Again, this is still a big IF. Here are the charts:

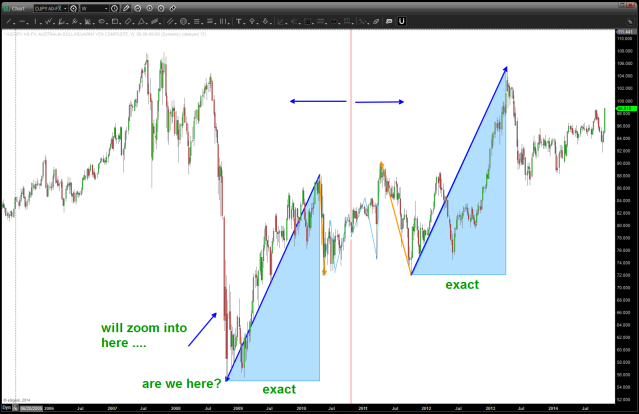

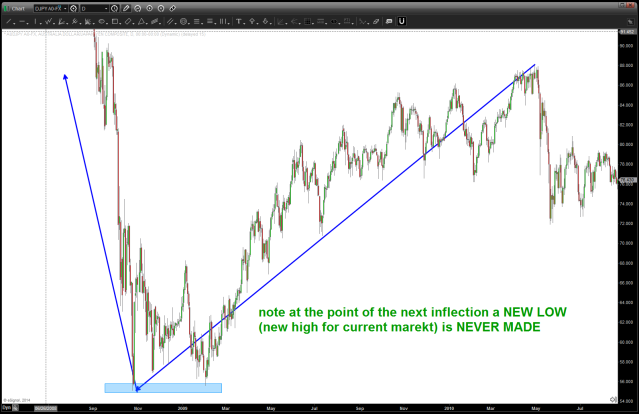

Now look at this MIRROR IMAGE holdback pattern on AUDJPY:

AUDJPY 2009-2010 CHART

AUDJPY Fractal Chart (2008 and Now)

Thanks For reading.

Read more from James on his blog. Follow Bart on Twitter: @BartsCharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.