The Housing market run into some trouble over the near-term… But the long-term picture is still bright.

I recently wrote about the strengthening economy and housing boom in the United States… and how a Millienial tailwind should give the market a boost over the coming 5-10 years.

So why am I negative looking out over the near term? Let’s address that today.

Over the coming quarters, the U.S. housing market find trouble, and it’s not because of the Federal Reserve hiking interest rates. Two Words: Expensive materials!

First and foremost my heart goes out to the families whose lives have been lost or impacted by these horrific global events. Lumber prices are skyrocketing due to the recent natural disasters not only in the U.S. but around the globe. Hurricanes in Texas, Florida and the Carribean have been extremely devastating thus far in 2017. To top it off, the folks out in California are dealing with unprecedented wildfires.

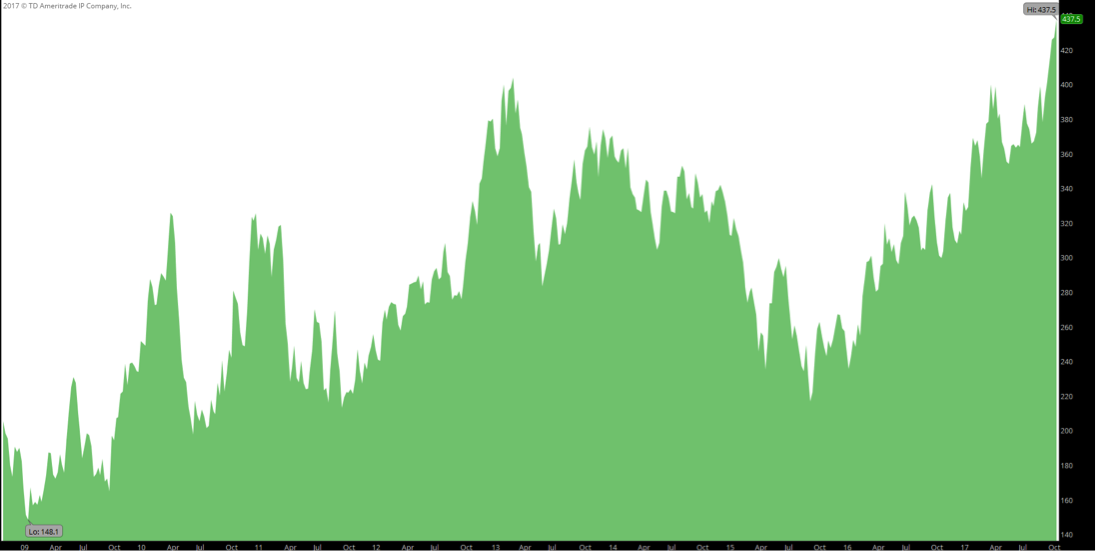

Lumber prices are skyrocketing the last few months breaking out above the 2013 highs… Lumber futures are up 23% YTD and show no signs of backing off – see chart below.

Here are a few more signs of inflation and rising input costs…

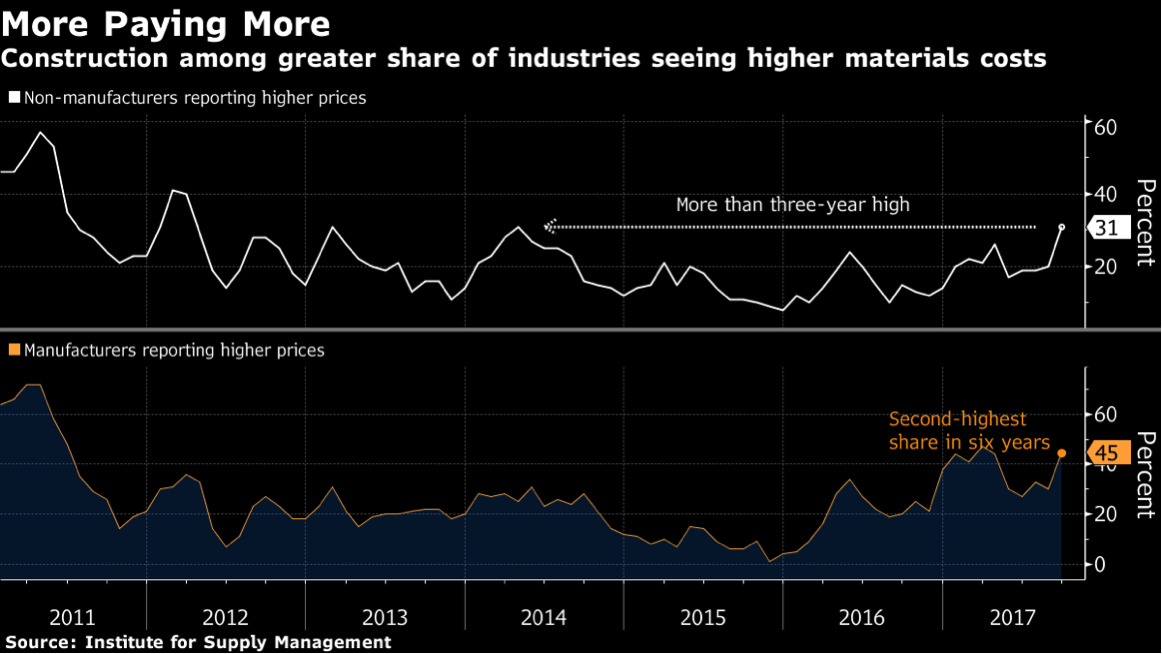

The Institute for Supply Management’s recent data shows an increasing concern that manufacturers are reporting higher prices.

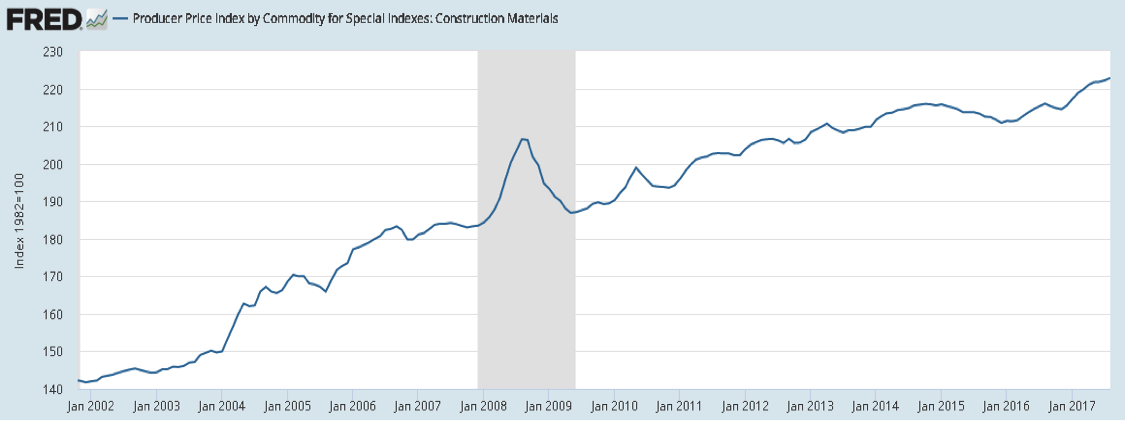

The Producer price index for construction materials also breaking out to new highs… Not a good sign as higher prices will be pushed through to the consumer. And this spells trouble for the housing market.

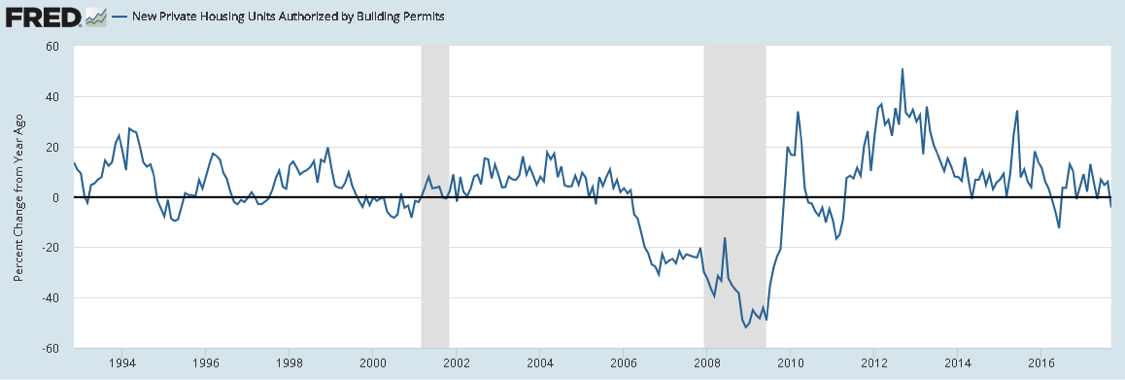

Higher prices starting to show a negative effect as new housing starts year over year are now negative.

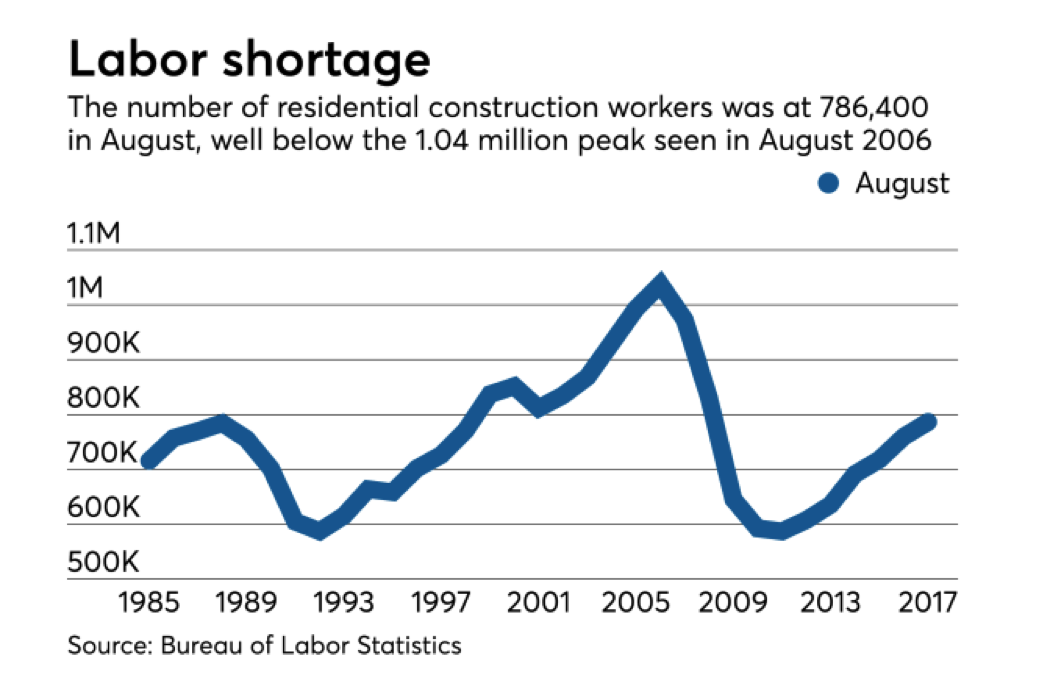

Finally, to make matters worse, there is a major shortage in the residential construction industry which at one point back in 2006 peaked at 1.04 million workers compared to today’s number which sits at 786,400.

I will be watching housing very closely over the next few quarters to see if this has a more major effect on the housing market. Thanks for reading and hope you enjoyed the article. Safe trading.

Twitter: @MacroTrader4

The author or his clients may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.