While select technology and semiconductor stocks have had a profound effect on the stock market rally, another less sexy sector has quietly provided leadership as well.

The Homebuilders Sector ETF (XHB).

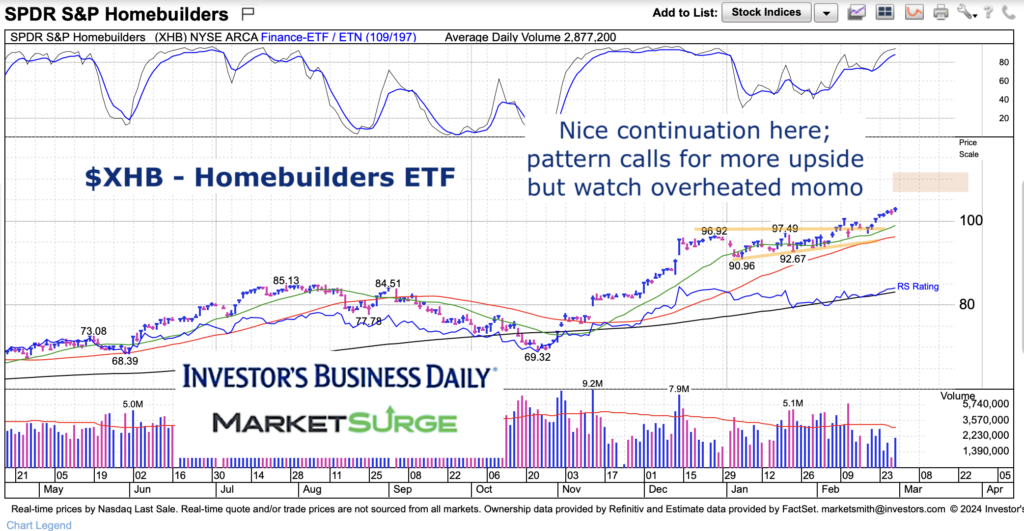

A strong October to January rally was followed by a period of consolidation. That consolidation soon became “continuation” as XHB and the homebuilders are headed higher again.

Today, we give the Homebuilders ETF (XHB) the love they deserve.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$XHB Homebuilders ETF Chart

By the size of the consolidation, the near-term rally could carry up to the 107-110 area.

It’s worth noting that momentum is pretty hot so a quick move to that level may bring consolidation and wait for the 20/50 day moving averages to catch up.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.