The stock market steadied itself, as the major indices clear or head to new highs.

Additionally, the media has slowed its aggressive inflation stance and looks to be shifting into the next trend as the infrastructure bill comes closer to passing.

However, whether the media places inflation in the spotlight or moves on to higher trending topics, we should keep it on the sidelines, for one big question still needs to be answered.

How do we pay for this new 1.2 trillion-dollar bill over 8 years?

The current administration proposed a tax raise on corporations which ultimately failed to hold ground. Without any new ideas that either party can agree on, it looks as though taking on more debt through auctioned government bonds will likely pay much of the bill.

With that said, to keep investors excited enough to take on U.S debt, the country will need to keep its strong market outlook and progress.

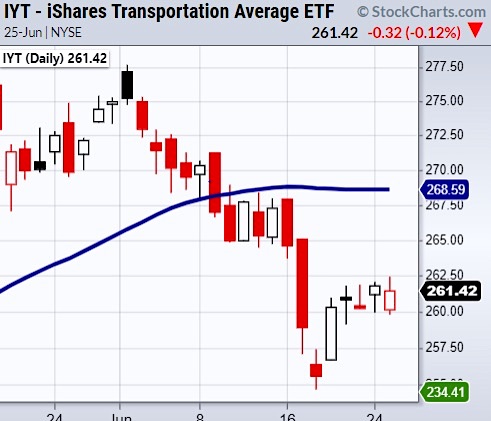

Therefore, we have been watching the transportation sector etf (IYT) as it shows the demand side of the market and can signal fading market momentum if it begins to trend lower.

At the current price levels, IYT needs to hold over recent support at $254.

However, if IYT breaks down, stay cautious as the indices could have trouble holding highs.

Infrastructure Bill – Four Market Areas To Focus On:

Stock Market ETFs Trading Analysis:

S&P 500 (SPY) Trading at new all-time highs.

Russell 2000 (IWM) 233.64 is next price resistance level.

Dow Industrials (DIA) Watching for a second close over the 50-day moving average at 342.27.

Nasdaq (QQQ) 342.80 is price support.

KRE (Regional Banks) 63.63 is price support. 68 is a choppy price area.

SMH (Semiconductors) 257.54 is price resistance.

IYT (Transportation) 254.65 is price support.

IBB (Biotechnology) Needs to hold the 159 price level. 163.63 is price resistance to clear.

XRT (Retail) Watching to see if 97 holds.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.