“Clap along if you feel like happiness is the truth … Clap along if you know what happiness is to you.” – Pharrell Williams

Happy times are here again and the financial crisis seems like a distant memory, at least judging by record highs on the U.S. stock indexes.

But is everything really hunky-dory? I might be crazy, but some interesting patterns I’ve noticed in consumer confidence and the velocity of money suggest perhaps not. The Federal Reserve and other central banks with their economic stimulus have thrown an epic bash in global financial markets, but not everyone is clapping along with the party music.

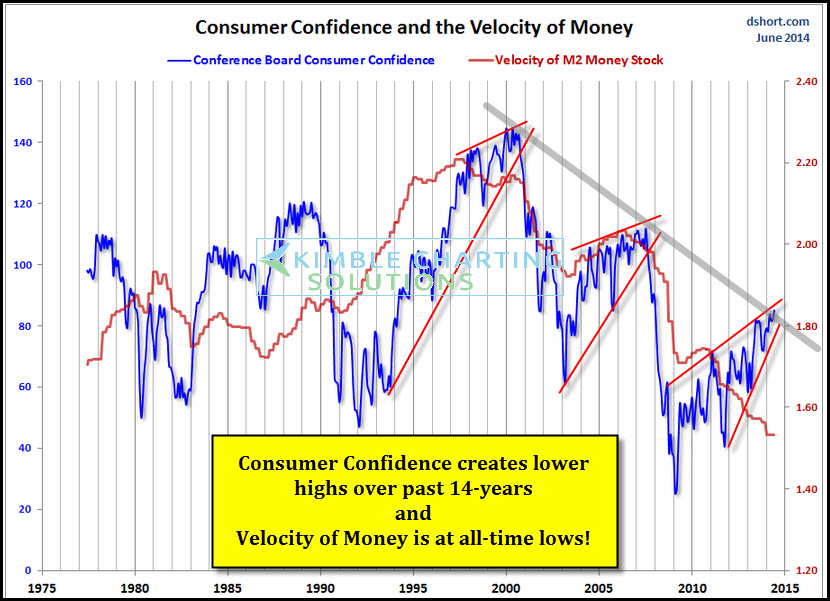

Check out the long-term chart below from Doug Short that plots out consumer confidence and the velocity of money. For those not fluent in economist-speak, Investopedia defines the velocity of money as the rate at which money in circulation is used for purchasing goods and services, and the measure helps investors gauge how robust the economy is.

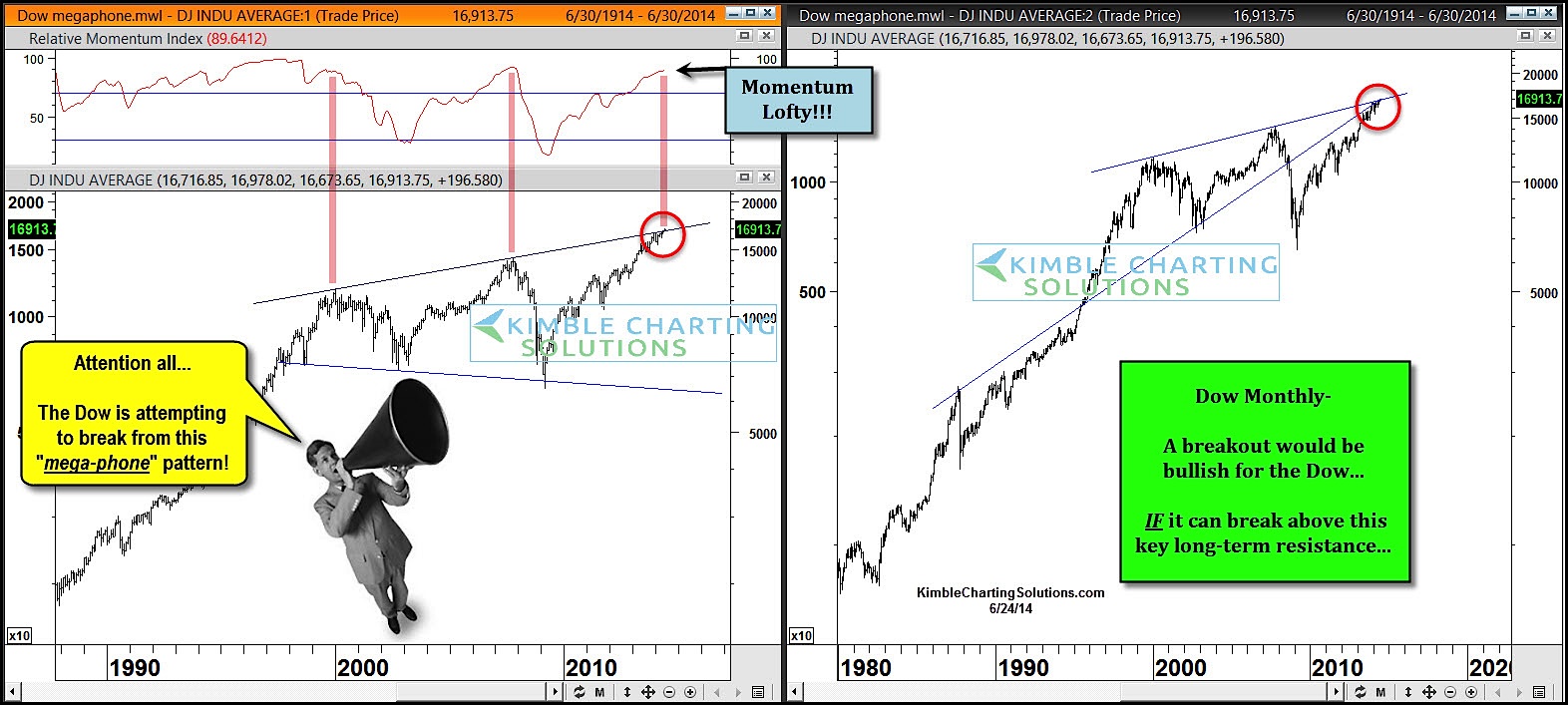

You’ll notice that consumer confidence is creating a series of lower highs over the past 14-years and the velocity of money is hitting the lowest readings in history. Meanwhile, in U.S. stocks, the Dow Jones Industrial Average has rallied to the top of a so-called megaphone pattern.

For me, the bottom line is that the Fed seems to be having a positive influence on stock prices, yet the average American isn’t feeling so buoyant. Do consumers really trust what is going on in the stock market?

Former Fed governor Kevin Warsh and hedge fund icon Stanley Druckenmiller in a recent WSJ op-ed wrote about what they call the asset rich, income-poor economy.

“The aggregate wealth of U.S. households, including stocks and real-estate holdings, just hit a new high of $81.8 trillion,” they said. Yet the Fed’s unprecedented stimulus “provides little solace for families and small businesses that must rely on their income statements to pay the bills. About half of American households do not own any stocks and more than one-third don’t own a residence.”

It seems the Fed’s “extraordinary tools are far more potent in goosing balance-sheet wealth than spurring real income growth,” they remarked.

To steal a page from Pharrell Williams:

…can’t nothing bring investors down as stocks continue to set new all-time highs. But it seems like a lot of people aren’t clapping along.

Follow Chris on Twitter: @KimbleCharting

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.