By Andrew Nyquist

By Andrew Nyquist

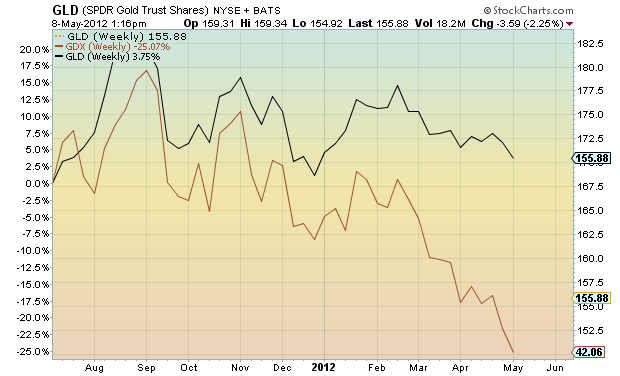

Gold (GLD) is taking it on the chin today, and as a consequence, the Gold Miners (GDX) are getting bludgeoned. Not a huge surprise here, as the Miners have significantly underperformed Gold since the top in Sept 2011 (see chart 1 below). The general washout is not a surprise either, as the charts had been weak for a while (see my April post “Precious Metals a Mixed Bag“).

Be that as it may, this washout will likely create “tradable buying opportunities.” In fact, I have been picking at the Gold Miners (GDX) today. Note that GDX is nearing the 50% fib retracement of the 3 year up move from October 2008 lows to September 2011 highs. 40-42 zone “should” provide some support (see chart 2).

——————————-

Twitter: @andrewnyquist and @seeitmarket Facebook: See It Market

Position in GDX at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.