The following article is a part of my Gone Fishing Newsletter that I provide to fishing club members each week to identify macro inflection points and actionable micro trade set-ups.

Sometimes commodity. Sometimes currency.

Sometimes hedge on Central Bank distrust. Sometimes outright fear trade.

Sometimes hedge on inflation. Sometimes alternative store of value during deflation.

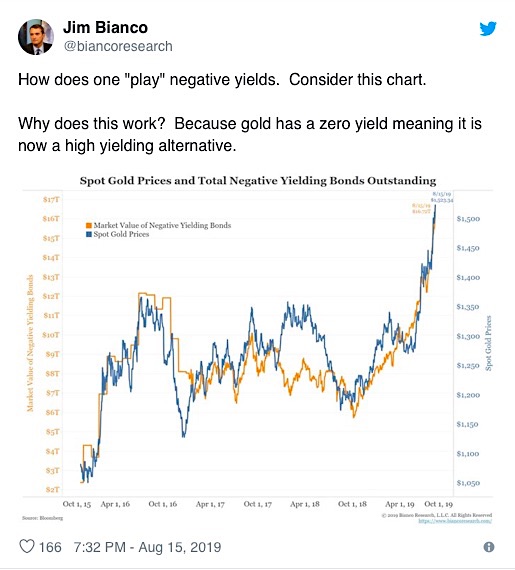

Gold NYSEARCA: GLD is also now a beneficiary of negative interest rates and here’s why:

It’s hard to believe the price of Gold can move significantly higher after it’s recent run this year… until you see these next few charts:

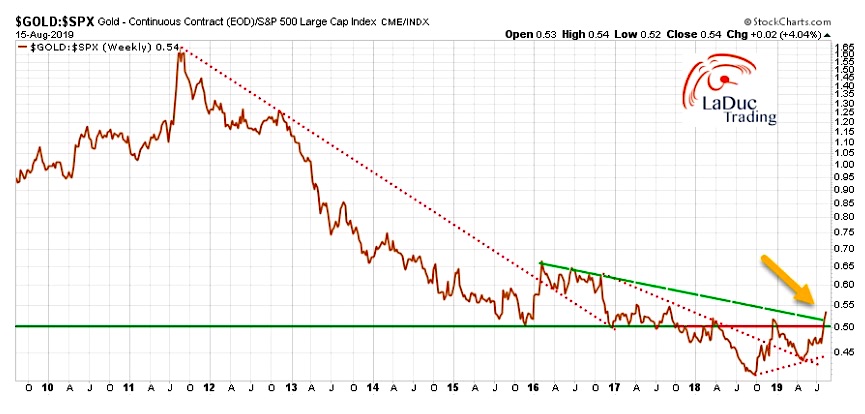

By inference, Gold can continue higher as the S&P 500 Index sells off (or consolidate here as the S&P 500 sells off).

There is also a correlation that USDJPY currency pair will break lower forcing the Japanese Yen higher.

And here’s the Yen in escape velocity mode as I projected in my DailyFX Interview June 6th!

An intensifying currency war as well as the heightened risk of a global recession are also solid reasons for the continued buying in Yen and Gold.

What would not be favorable is a reversal in rates (higher) pulling US Dollar (higher) with them.

However, given the growing efforts by Navarro and Trump to talk the USD down, insomuch as suggesting Treasury intervention to devalue the USD in order to better compete on the global trading stage, there could be even more impetus to own gold, silver, miners and associated currencies like Yen as these above charts suggest.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.