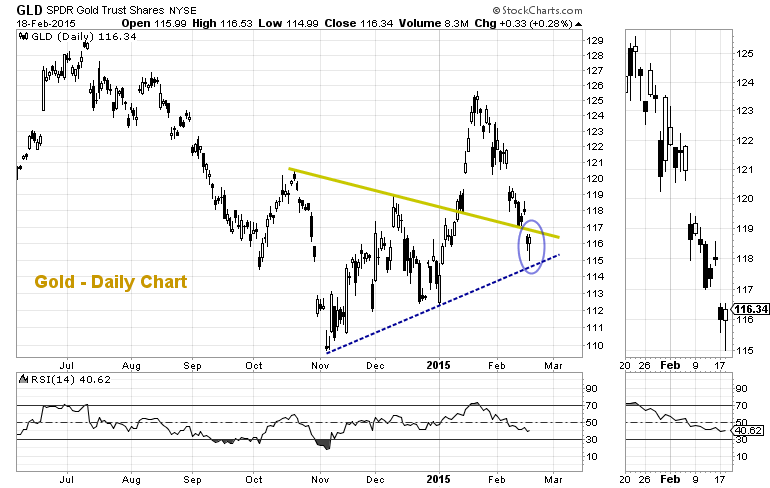

Gold futures dropped sharply this morning, hitting a low of 1197 and taking the Gold ETF (GLD) down with it. In the process, GLD broke through a backtest support line. By all accounts, this looked like a continuation day to the downside. BUT, something interesting happened: there was a big GLD reversal. And this reversal could setup a tradable rally.

So what set up this GLD reversal and what do we make of it? Well, since topping on January 22nd, GLD had fallen 8.4% (intraday highs to lows), so it was a bit extended. As mentioned above (and seen below), GLD fell through its backtest support and into its near-term uptrend line (final and critical support). This overextension also caused some trading longs to throw in the towel (capitulate), setting up GLD’s intraday reversal – this shows up in the “stem” of the candle.

It’s important to note that this is a very short-term setup that requires follow through back above the yellow line (prior support) to trigger; although visible, the reversal was just 1.3%. It is also embedded within a multi-week pullback, so Gold still has a lot to prove here. Potential upside GLD targets would be 117.98 (gap-fill) and 119.50 (the beginning of the island gap area. The next area to watch is the multi-day island gap reversal. This gap represents strong resistance.

GOLD (GLD) Daily Chart

Thanks for reading and remember to always trade with discipline.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.