We had a number of buy triggers last week in not only U.S. stock market indices, but also for Spain, Italy, the Nikkei and the Hang Seng.

Below is a recap of the major stock markets around the world with a brief update, news and analysis.

U.S. Equity Markets

We got a number of buy signals last week in the S&P 500 Index INDEXSP: .INX, Nasdaq Composite INDEXNASDAQ: .IXIC, Russell 2000, Mid-Caps Index and the Dow Transports.

Large caps continue to lead, and the buy signal in the S&P appears stronger, given the pullback it had.

The Dow Utilities remain in our target zone, and we have been advising to trim. No major sell signal yet.

European Markets

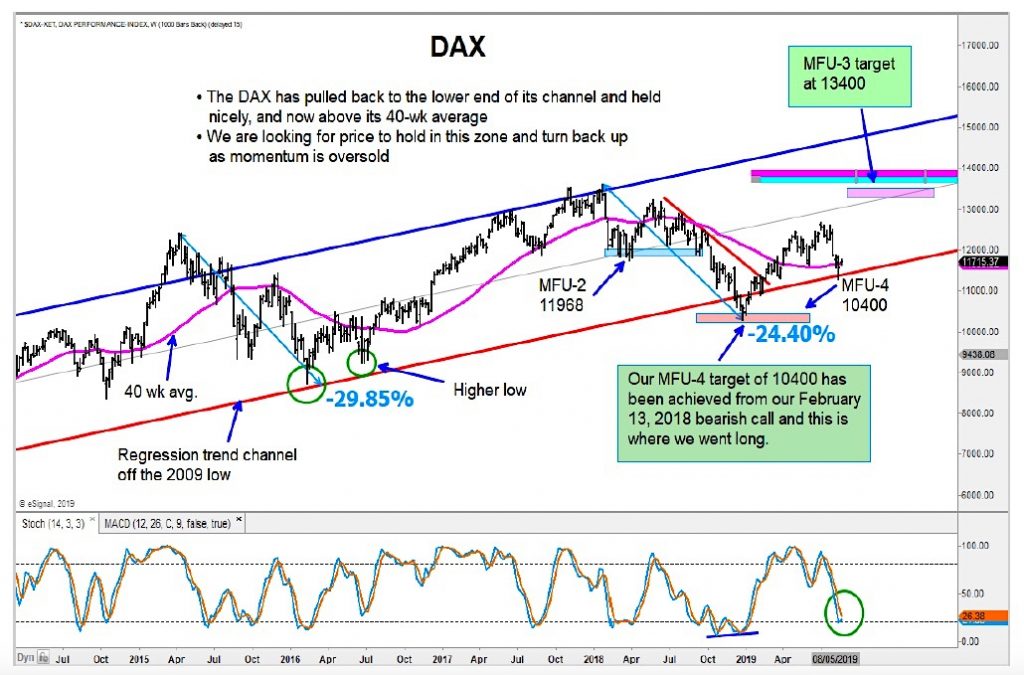

The German DAX and French CAC both pulled back to their respective 40-week moving averages and channel support. The 40-week averages are sloping up, which is positive, and we would be buying right here.

Spain’s IBEX is down to critical support that needs to hold in the coming days.

Italy’s FTSE MIB had an ellipse buy trigger as it held at channel support. The 40-wk has turned up and we would be adding right here.

The MSCI UK ETF (EWU) remains in a weak position.

Asian Markets

The Aussi All Ords remains in a weak position short-term as the MFU-4 target caped the high.

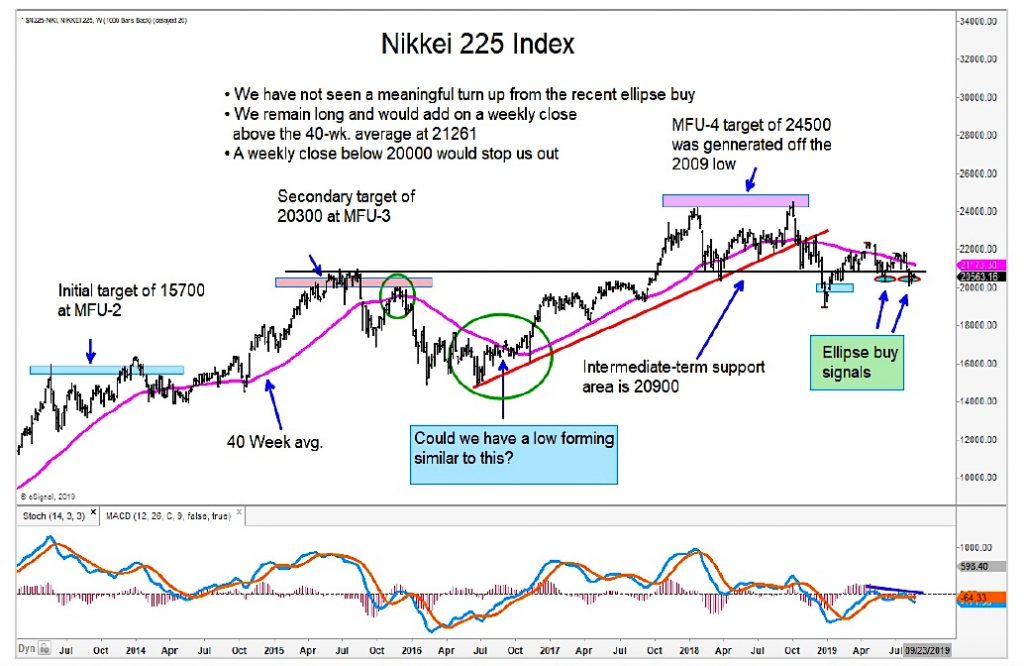

The Nikkei is holding its ellipse buy zone and needs to turn up from here.

Emerging Markets

Last weeks pullback in the Hang Seng held at the ellipse buy zone with momentum divergence. We would be adding small here.

We remain cautious the Kospi 100.

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.