Inter-market analysis of stocks, bonds, and currencies are aligning and should be supportive of another move higher for the German DAX stock market index.

Furthermore, Elliott wave analysis also supports another rally to new highs for the German DAX.

This should coincide with a bit more weakness in the EURUSD as the US Dollar remains strong heading into the Federal Reserve meeting. US bond yields are moving slightly higher, in step with the Dollar.

Below we share short-term Elliott wave trading charts with some blended inter-market analysis.

German DAX set for another wave higher…

Stocks are still strong with an overall bullish/risk-on mood that is expected to resume after minor retracements. I am also eyeing crude oil which may be headed higher after an intraday set-back as well.

Ideally, XXX/USD and XXX/JPY pairs will continue higher after pullbacks, but with JPI crosses being in better situation based on price action. The only threat and worrying situation are Chinese stocks after tense U.S.-China meeting.

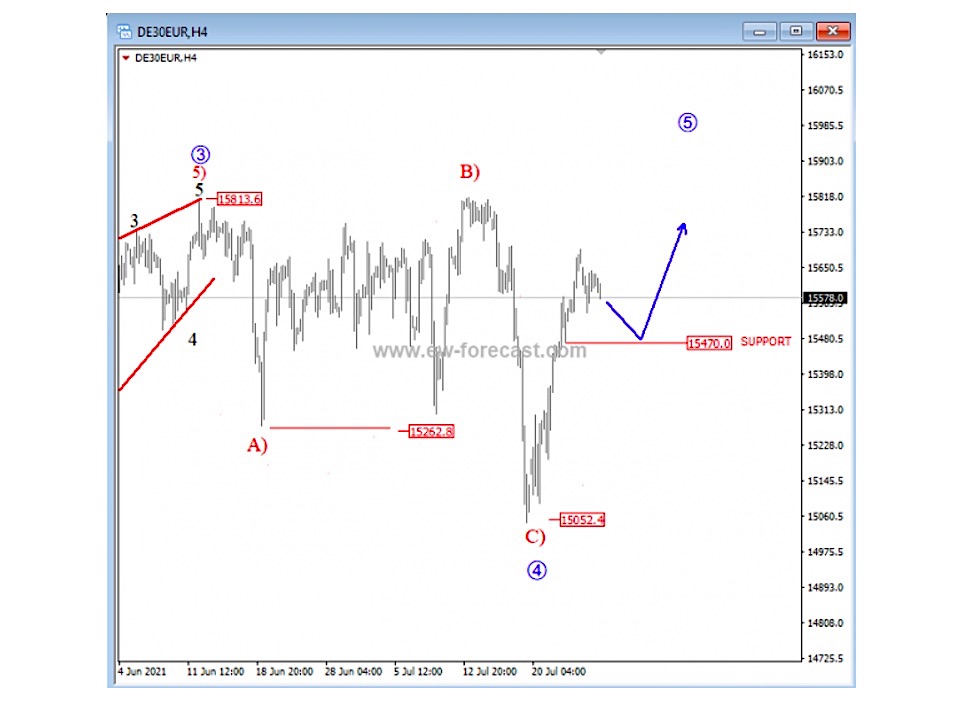

Looking at the German DAX Index, we can see that this market is recovering in impulsive fashion after we noticed an A-B-C flat correction within a wave higher degree wave IV. sggSo with the current strong rebound, the German DAX Index is pointing back to highs for wave 5 towards the 16000 area or higher.

DAX 4h Elliott Wave Analysis Chart

Finally, another ELLIOTT WAVE OPEN DOOR Event is here. See all of our charts FREE for 10 days. Join us at Elliot Wave Forecast!

It will be interesting to see if EURUSD can also look for a support after this final dip to complete an ending diagonal.

EURUSD 4h Elliott Wave Analysis Chart

Twitter: @GregaHorvatFX

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.