Why has the market been so strong in April with the high unemployment and terrible economic numbers?

A tried and true Wall Street adage is “Don’t fight the Fed.” When the Federal Reserve is backstopping the financial markets, the path of least resistance for stocks is almost always up.

The S&P 500 Index INDEXSP: .INX and broader market indices have also been bolstered by the plans that the economy is opening up and by news of possible treatments for the virus.

Is the Federal Reserve able to continue to make loans and stimulate the economy?

Key takeaways from last week’s Federal Reserve meeting:

– The Fed will keep rates low for a long time.

– Fed Chairman Powell is content with the liquidity and functioning of the financial markets.

– The Fed can and will do more to guarantee the flow of credit to households and businesses and state and local governments. They won’t run out of loan capacity.

– They ARE worried about long-term productive capacity if people remain unemployed too long which is why they will use “the full range of its legal powers” until they are confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

Will we see an economic recovery this year from pent-up demand?

We are going to recover and there will be pent-up demand but it’s hard to say how fast the economy will bounce back because there are so many unknowns regarding the length of COVID 19 and how consumers will behave once the economy begins to reopen.

The economy is experiencing a deep contraction but U.S. Treasury Secretary Steve Mnuchin and the Congressional Budget Office expect substantial growth to return in the third quarter of this year.

The federal government plans to build on policies that had been working before the pandemic hit – tax cuts for middle income workers, reduction of regulations, better trade deals, and boosting the energy system. In Sarasota where Mr. Bittles lives, will have a partial reopening this week but our economy never completely shut down. Some retail stores remained open and large construction projects were accelerated. We may experience a more robust recovery in Florida because of that.

The Commerce Department reported last week that consumer spending dropped 7.5% in March which was the largest one-month drop since the government began tracking the data in 1959. Consumer spending is 70% of our total economic output. Household incomes have been hurt by the stay-at-home order and 30 million people have lost their jobs. Those 30 million people will have to regain their jobs or may need to change jobs.

It may take months for businesses to rework staffing and inventories, and to implement new safeguards and different ways of doing business. Supply chains are already being reoriented to limit dependence on other nations. These are all good things to happen to us. We will be safer. We will have better savings habits. But we may experience a slower economic recovery because of the changes in the way business is conducted and because of changes in consumer spending habits.

Are we still in a bear market?

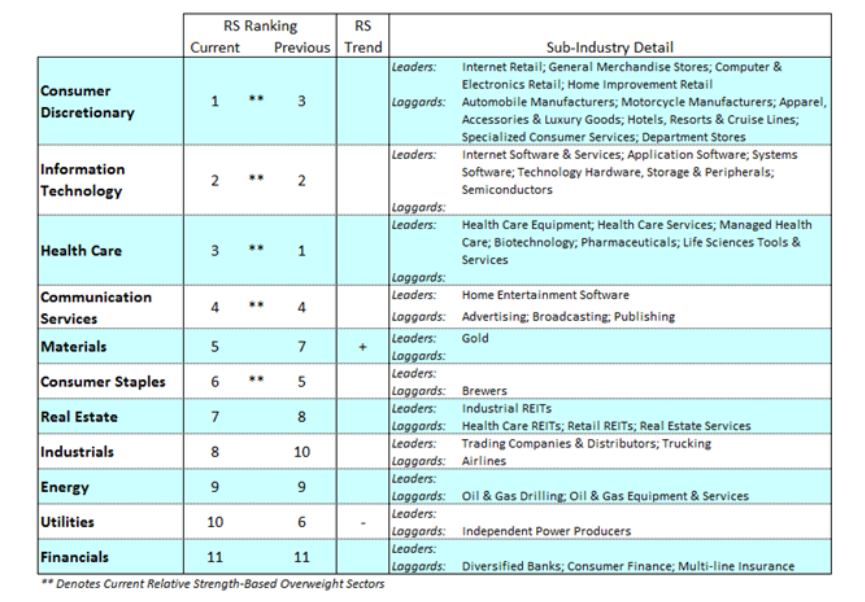

One of the signals of the early stages of a new bull market is that the leadership in stocks is usually concentrated in the small caps. You can also expect to see broad participation and not one sector leading the way, as evidenced in the current market.

The market rally over the past few weeks has been concentrated in the FAANG stocks (five largest stocks in the S&P 500 Index – Facebook, Amazon, Apple, Netflix and Google), and a few healthcare stocks. Momentum can drive a rally higher but a sustainable advance requires participation from a broad group of sectors and individual stocks. A broad participation in the market signals that investors are optimistic about the prospects for economic growth. Currently only 21% of S&P stocks are trading above their 200-day average.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.