Pretty much everyone has turned into a bear. And no surprise really.

Personally, I think the bears are a bit late to the party. Nonetheless, the inflation concerns are real. The QT concerns are real. Yet the worries about recession, although real, may not necessarily come to pass as most feared.

As you may know, I am a huge fan of the Economic Modern Family. The EMF is made up of one index (Russell 2000) and five sectors (Retail, Transportation, Regional Banks, Semiconductors, Biotechnology) plus the newest member-Cryptocurrencies (Bitcoin).

Last week, the most dismal consumer confidence report showed historical lows. Also, no surprise.

However, the Retail sector of the EMF, whom I like to call Granny Retail, has exhibited some interesting positive relative performance.

Whether it sustains or not remains to be seen. Clearly, the FOMC will have its say in the immediate future of the market and economy.

Why Is Granny Retail so key?

With inflation on everyone’s lips and the price of gas and food showing no signs of abating, the retail sector is the key to assess where the equity market goes from here.

The weekly chart of Retail XRT that we showed in yesterday’s daily shows it is holding onto its weekly 200 MA at 60.62.

Now, two things you should know.

First, we are not talking our position as we have virtually no equities in our holdings in the discretionary fund. We do have a few in our quant models, but they are mainly energy related.

Secondly, a weekly chart is only as good as its weekly close. And even with that, we generally look for confirmation the following week.

So, if XRT closes above 60.62, perhaps we got something to look at for next week. Otherwise, we most likely can count on another leg down.

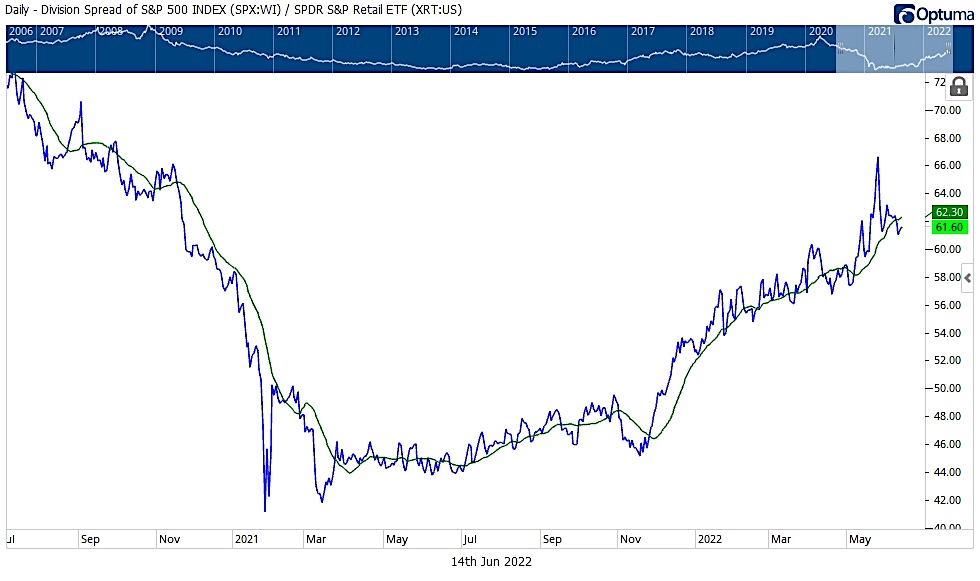

The chart we include shows the relationship between the retail sector and the S&P 500.

The two charts show XRT, then XRT daily and weekly price spread to SPX, so the price spread depicts the ETF’s relative performance compared to the S&P 500 (SPX/XRT).

A rising price spread shows outperformance, and a declining price spread illustrates poor relative performance.

Currently, the daily chart shows how well XRT has outperformed until this past week when the ratio has declined a bit.

The weekly chart on the other hand, illustrates how despite everything, XRT remains robust compared to the SPX.

Again, we have no skin in the game at this point. Should we see XRT hold up along with IYT, we will see that as a good sign and look at stocks like Nordstrom, Dollar Tree, and GameStop.

Otherwise, we will continue to play defense and hope a trading floor establishes itself soon.

Watch Jared Blikre and Mish sit down to discuss her history, investing and the future.

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) 380 is now pivotal price resistance with 360 being the next support.

Russell 2000 (IWM) 168.90 is the May low so will see if it can hold.

Dow Jones Industrials (DIA) 306.28 is the May low, with pivotal support below at 294.

Nasdaq (QQQ) 263 is the 200-weekly moving average with 280.21 price resistance.

KRE (Regional Banks) 56 is the 200-weekly moving average.

SMH (Semiconductors) 195 some minor support with 220 resistance.

IYT (Transportation) 211.87 is the 200-weekly moving average to get back above.

IBB (Biotechnology) 105.39 pivotal area.

XRT (Retail) 60.62 the important 200-WMA support line.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.