The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

On Friday, April 7, First Republic Bank (FRC) announced they would report Q1 2023 earnings on April 24 after market close. This is 11 days later than expected, the first Monday report ever and the first after-the-bell report ever. This also pushes quarterly earnings results past FRC’s monthly options expiration date of April 21. If you follow any of our delayed earnings work here at Wall Street Horizon, you know this doesn’t bode well for the upcoming call.

Academic research shows when a corporation reports earnings later in the quarter than they have historically, it typically signals bad news to come on the conference call. The reverse is also true, an early earnings date suggests good news will be shared. The idea is that you’d prefer to delay bad news, but when you have good news you want to run out and share it.

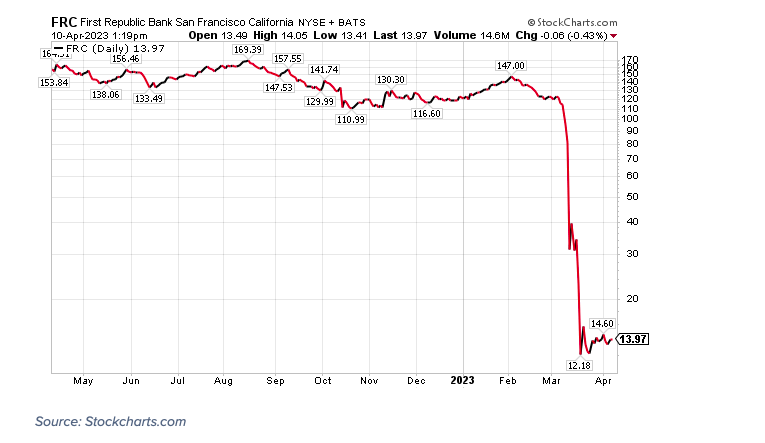

It probably comes as no surprise that First Republic Bank might want to delay their earnings results after a whirlwind first quarter. The 14th largest regional bank in the United States has become one of the focal points of the banking crisis. After the collapse of Silicon Valley Bank provoked panicked withdrawals from various regional banks, JPMorgan Chase along with 10 other large banks bailed out First Republic with $30B in backstop funds.

That massive measure hasn’t seemed to help, however, as the following day FRC announced they were suspending their dividend on common stock, and just this morning they announced they were also suspending their dividend on preferred stocks. The stock is down 88% YTD.

FRC is currently working with bankers at Lazard to review their options which seem to be dwindling. Their outlier earnings date (resulting in a massive z-score of 10.3) is just another sign that the floundering bank is likely struggling to stay afloat.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.