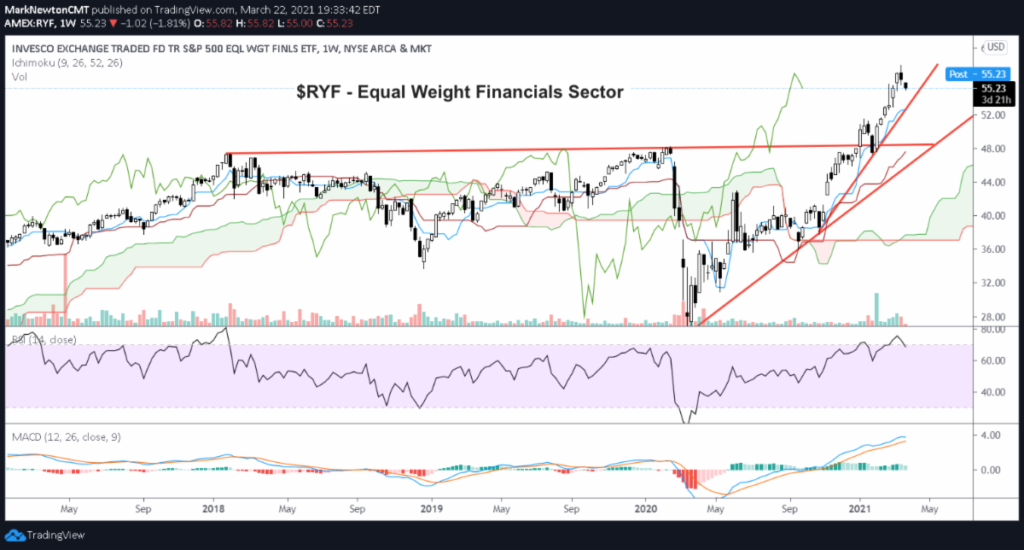

The Financials Sector and select stocks have started to waver in the last few days.

This appears to be a combination of extreme overbought conditions along with Treasury bond yields starting to pullback.

Today we look at the financials via the Invesco Equal Weight Financials Sector ETF (RYF). This sector had gotten very overdone and important to monitor given its weighting within the S&P 500; this is a far more important sector than Energy, Materials or Industrials in terms of how it guides stock market indices.

The long-term treasury bond ETF (TLT) is on the verge of an above-average bounce given RSI has pulled back to extreme oversold conditions on weekly charts, while monthly charts are right near support. While credit card stocks like Visa (V) and Mastercard (MA) are attractive, many of the Brokers like Goldman Sachs (GS) and Morgan Stanley (MS) have gotten very overbought and look like poor risk/rewards on a 3 to 6 month basis. Those involved with this group should keep stops tight on longs.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.