The EUR/USD Selloff Continues Unabated, But A Historic Extreme In Short-Term Momentum Signals A Euro Relief Rally May Be At-Hand.

The EUR/USD Selloff Continues Unabated, But A Historic Extreme In Short-Term Momentum Signals A Euro Relief Rally May Be At-Hand.

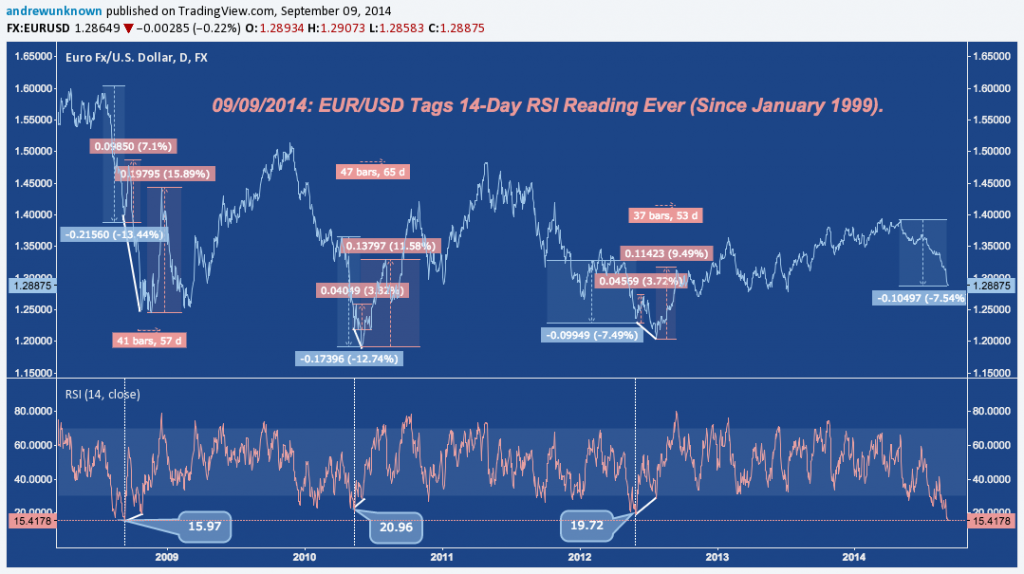

EUR/USD tagged its lowest 14-day RSI reading ever (Since January 1999) today, signaling it is massively, historically oversold.

Past RSI prints near 20 are few; but where they have occurred vicious short-covering rallies aren’t far behind – no matter the monetary/fiscal policy regime – registering double-digit gains in a matter of 8-9 weeks. All three rallies noted in the chart below were preceded by a positive momentum divergence in which price eventually made a lower low as RSI put in a higher low. Between these price lows, strong intermediate corrective rallies of 7.1%, 3.72% and 3.32% occurred.

EURUSD may continue much lower – to wit, I argued this looks like the most probable medium-term outcome in last weekend’s US Dollar and EUR/USD analysis – but can it do so without a Euro relief rally/dead cat bounce to reset momentum in the short-term and alleviate extreme COT positioning?

Trade ‘em Well.

Twitter: @andrewunknown

Author holds no position in the securities mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice. Chart courtesy of TradingView.com