As the European Central Bank gets ready to start its version of QE on March 9, the Euro waterfall decline continues to unfold. In fact, the Euro is in free fall again this morning after the US Jobs report shows signs of life in the US economy, propelling the Dollar higher and Euro lower.

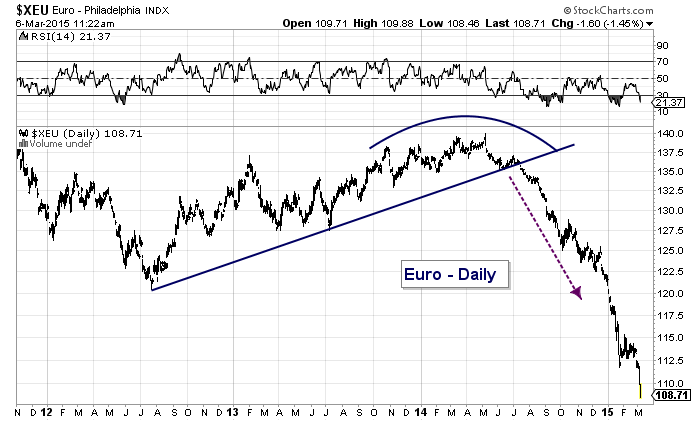

So where does that leave the Euro in terms of its decline? Several short-term Euro technical support levels have been broken as its decline has been relentless. Let’s take a quick look at the Euro waterfall decline for some perspective.

Euro Waterfall Decline Chart – 2014-2015

The combination of a rapidly slowing economy, divisive politics, and the introduction of European style QE has hit the Euro hard. So where will the current waterfall decline end? And is there a Euro technical support level that we should be watching?

ALSO READ: US Dollar Secular Bull Market Flexes, But Correction Near by Sheldon McIntyre

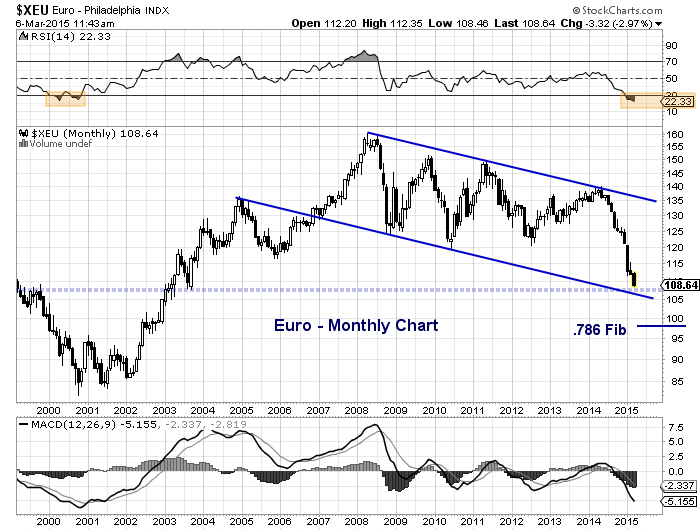

Well we need to zoom out to the monthly chart for a better perspective. On the chart below, you can see that the Euro is fast approaching a convergence of technical support around 106-108. That very well may halt the waterfall decline. As you can see, the monthly Relative Strength Index (RSI) is at 22 and falling. But in my experience, bounces out of deeply oversold conditions can see an undercut within a handful of time periods later – see the Euro bottom in 2000. This would equate to a temporary bottom this month or next, and an undercut later this fall. But, again, that can only happen if the Euro slices through the 105-107 support.

Euro Monthly Chart – Euro Technical Support Levels To Watch

Picking bottoms in any waterfall decline is risky, and not something that I advise. It’s probably a better idea to use this setup as a tool to better understand the global marketplace. And from this perspective, I do see a Euro bounce coming soon that will need to be monitored going forward. Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.