The Euro currency is sliding and international markets are taking notice.

Of course, this is coming as the US Dollar rallies… and all this means pain for the Emerging Markets and its trading ETF (EEM).

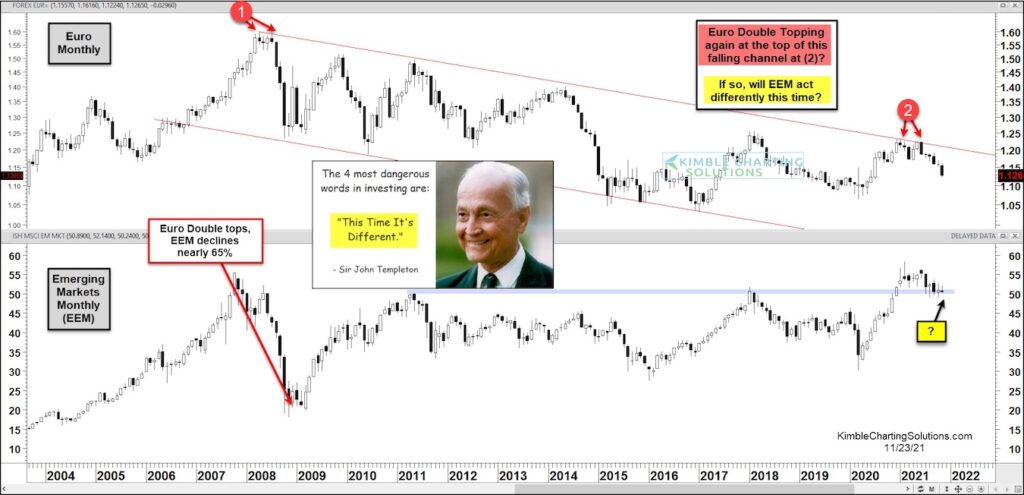

In today’s chart 2-pack, we compare the Euro to the Emerging Markets (EEM) over the past 2 decades (on a “monthly” basis).

As you can see, the Euro has been in a declining channel for the past 13 years. And the channel started with an ominous double top pattern at (1). That double top also triggered a huge decline (-65%) in the Emerging Markets ETF (EEM).

Fast forward to this year, and the Euro has double topped once again at (2). This has sent the Emerging Markets lower and now has EEM testing critical price support.

If Euro weakness pushes EEM any lower, it could lead to another major decline. Stay tuned!

$EURUSD Euro Currency versus $EEM Emerging Markets Performance Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.