The US Dollar is consolidating in what appears to be an Elliott wave corrective retracement. And we could see a bit more US Dollar weakness ahead, especially versus strong currencies like the Australian Dollar (AUD), the Canadian Dollar (CAD) and the New Zealand Dollar (NZD). So what’s that mean for the Euro and Euro currency pairs crossed with these strong commodity currencies.

Well, it’s a unique situation, with some Euro currency pairs trading in strong trends.

EU Manufacturing PMI came out at 58.5 vs 57.8 expected, while Services PMI came out at 54.7 vs 55.5 expectations. Select Euro pairs are trying to climb slightly higher on the data and ideally, the Euro will resume back to 1.1669 high as the current move for the Euro looks to be corrective.

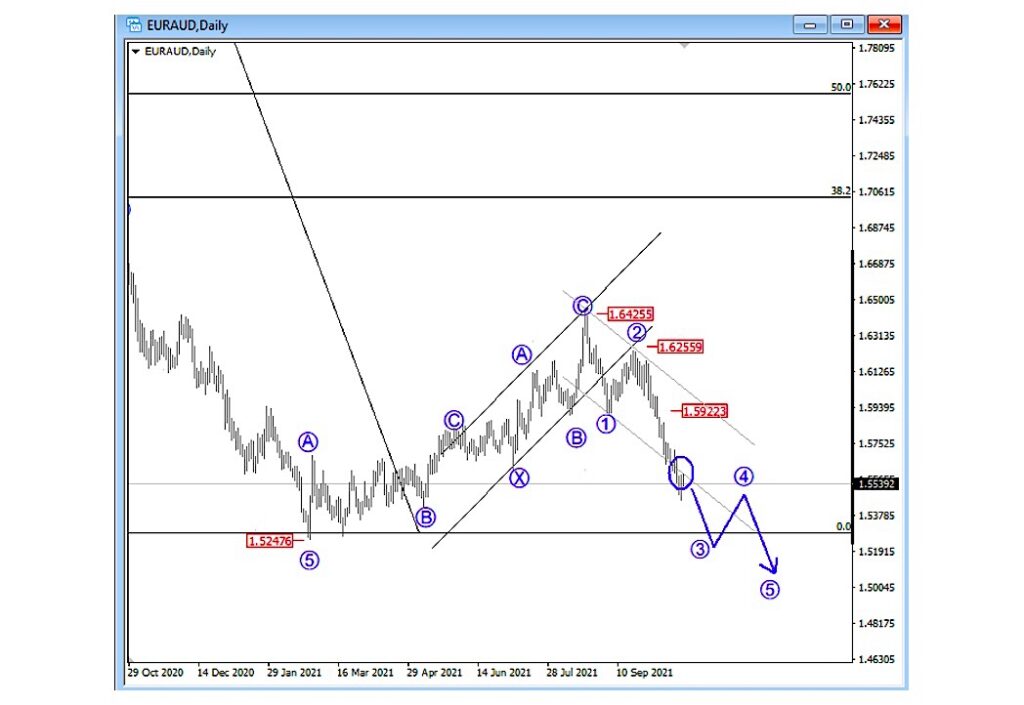

Let’s look at the Euro/Aussie currency pair (EURAUD) first. The EURAUD is sharply down after we noticed a complex 7-swing Elliott wave correction and now it’s even breaking below base channel support line which indicates for wave 3, so be aware of more weakness within a five-wave cycle, just watch out for a pullback in wave 4 that can occur around February lows.

EURAUD 4h Elliott Wave Analysis

EURNZD is turning sharply and impulsively down on a daily chart after we noticed a correction in wave 4 of (3), which looks to be completed now after the recent break below channel support line. Well, seems like wave 5 of (3) is already in progress which should be completed by a five-wave cycle of the lower degree, so watch out for more weakness in upcoming days that can send the price back to February lows.

EURNZD 4h Elliott Wave Analysis

Twitter: @GregaHorvatFX

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.