The last few trading weeks have surprisingly choppy with the market unable to make up its mind on a convincing direction. The mornings are typically filled with bullish opens that fade in the middle of the day as momentum wanes. The key push for the bulls is to regain the prior highs and extend this most recent rally. The bears on the other hand are gunning to push the major indices below their short-term trend lines to re-establish dominance. Right now I gauge either scenario as being likely, with the bears perhaps having a slight edge given the propensity for greater volatility this year.

The last few trading weeks have surprisingly choppy with the market unable to make up its mind on a convincing direction. The mornings are typically filled with bullish opens that fade in the middle of the day as momentum wanes. The key push for the bulls is to regain the prior highs and extend this most recent rally. The bears on the other hand are gunning to push the major indices below their short-term trend lines to re-establish dominance. Right now I gauge either scenario as being likely, with the bears perhaps having a slight edge given the propensity for greater volatility this year.

The biggest concern that we are seeing is fewer buyers in high growth sectors such as biotech, solar and small cap stocks which have faded significantly from their highs. Both the iShares NASDAQ Biotechnology ETF (IBB) and Guggenheim Solar ETF (TAN) have now given back more than 13% on a closing basis from their high water marks. Granted these sectors have both seen triple digit gains over the last 52-weeks, so it only makes sense that they would be more susceptible to a pullback.

The recipients of these asset flows have been in safer areas of the market such as the long-duration treasuries and large-cap stocks. The iShares 20+ Treasury Bond ETF (TLT) has been acting as a shelter from the storm during pressured selling days and the SPDR Dow Jones Industrial Average ETF (DIA) has also been outperforming other indices on a relative basis as of late. This is being labeled as a warning sign by many professional investors because a rotation from small caps to large companies may be seen as a precursor to a bigger market pullback.

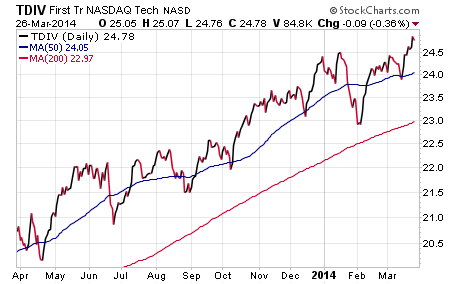

One area in particular that has been holding up well lately is larger dividend paying technology companies. The First Trust NASDAQ Technology Dividend ETF (TDIV) is a core holding for my clients and is chocked full of technology and telecommunication stocks with large cash positions, mature business models, and established dividend histories. The top 3 holdings include: International Business Machines (IBM), Microsoft Corporation (MSFT), and Apple (AAPL). The current yield on this ETF is 2.80% and dividends are paid quarterly to shareholders.

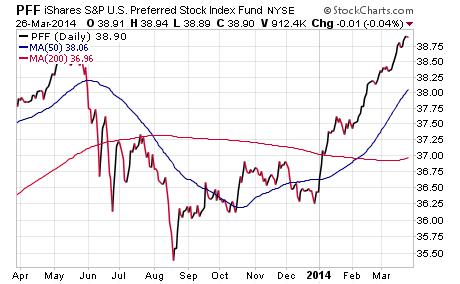

Another equity-income theme that has been very resilient this year has been the iShares U.S. Preferred Stock ETF (PFF). I own this fund for both its income and growth characteristics. It was beaten up in 2013, but has returned with a vengeance this year and sports a 30-day SEC yield of 5.84% with dividends paid monthly.

The biggest boost to preferred stocks in 2014 has been stabilization in long-term interest rates which have acted as a tail wind for capital appreciation. Right now the fund is more richly valued than when we entered the year, but still offers a compelling yield and has been insulated from the volatility in equities.

Other defensive areas of the market such as utilities and consumer staples have also been performing well lately as this shift continues to materialize. My personal belief is that many investors are overweight high risk areas and we will see additional rebalancing as the year wears on. So far the damage has been minimal and the larger uptrend is still intact. However, it can be advantageous to pay attention to these trends in order to frame your asset allocation and risk management plan moving forward.

Originally published as a blog on FMD Capital Management. Twitter: @fabiancapital

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.