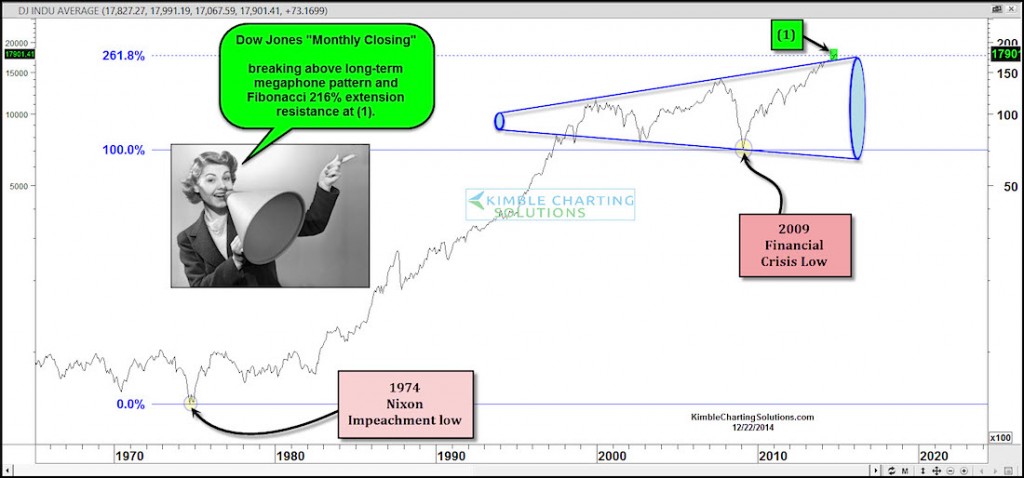

As the year is coming to an end and the Dow Jones Industrial Average (DJIA) is near all-time high levels, I thought it would be a good idea to take a peak at two different long-term perspectives. One of them comes into view with Fibonacci Extension levels, while the other offers a macro technical look at a long-term Dow Jones megaphone pattern.

First, let’s start with the Fibonacci Extension. If one applies Fibonacci to the lowest “monthly closing prices” during the Nixon impeachment and the 2009 financial crisis, the 261% Fibonacci extension level has come into play recently at the 17,600 level. And based on the recent rally, the Dow is attempting to breakout above this level at (1) on the chart below.

At the same time, we have a potential breakout above a long-term Dow Jones megaphone pattern (also clearly illustrated in the chart below). A sustained break above both levels by the Dow should be considered a positive sign for investors.

Dow Jones Long-Term Chart – Fibonacci & Megaphone Breakouts?

It’s also important to note that in October the Dow created the “largest bullish monthly wick” since the 2009 lows. This month the Dow is attempting to create another large bullish wick, near these key levels. We will see on 12/31/14 (the monthly close), if this large bullish wick is still in play… it would be just two months after the huge bullish wick in October!

These bullish wicks and positive messages from our Shoe Box, High Yields and Advance/Decline line indicators suggest that our slow money customers remain majority exposed to U.S. stocks.

If the Dow would reverse course here and our tools indicate a concerning message, we would reduce exposure ASAP! Thanks for reading.

Read more from Chris on his Blog. Follow Chris on Twitter: @KimbleCharting

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.