By Korey Bauer While everyone continues to pound the table saying that “this market is overbought” or “the market is topping,” stocks continue to do the exact opposite. And further, the stock market continues to be strong despite being up over 8% YTD. Within this context, I began digging into various strength and exhaustion indicators and realized that the Dow Jones Industrial Average (DJIA) has closed above its top Bollinger Band four days in a row. This prompted me to do a Bollinger Band study to determine if consecutive days above the top Bollinger band is an exhaustive signal for the Dow Jones and also to assess how the market tended to react to this phenomenon.

By Korey Bauer While everyone continues to pound the table saying that “this market is overbought” or “the market is topping,” stocks continue to do the exact opposite. And further, the stock market continues to be strong despite being up over 8% YTD. Within this context, I began digging into various strength and exhaustion indicators and realized that the Dow Jones Industrial Average (DJIA) has closed above its top Bollinger Band four days in a row. This prompted me to do a Bollinger Band study to determine if consecutive days above the top Bollinger band is an exhaustive signal for the Dow Jones and also to assess how the market tended to react to this phenomenon.

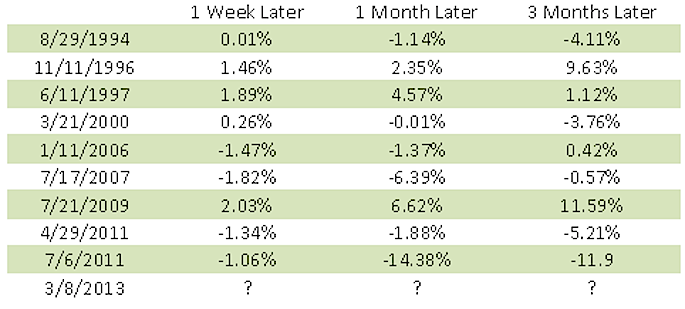

I did the study going all the way back to 1994, looking at the consecutive days the Dow Jones Industrial Average closed above its top Bollinger Bands (using four days in a row as my factor). This has only happened a total of 10 total including Friday, March 8, 2013. See the results below and chart below. Of the nine instances that we have data for, the results one week later were fairly mixed. However, the results one month later had the market down six out of nine times. Please feel free to provide thoughts/feedback in comments below. Thanks!

Click images to enlarge.

DJIA four consecutive days above top Bollinger Band Study – Results

Dow Jones Industrial Average – study dates highlighted with red arrow

Source: Worden Charts

Disclaimer: The material provided is for informational and educational purposes only and should not be construed as investment advice. All opinions expressed by the author on this site are subject to change without notice and do not constitute legal, tax or investment advice. At Castle Financial, securities are offered through Cadaret, Grant & Co., Inc. and TD Ameritrade, Inc. Members FINRA/SIPC.

Twitter: @stockpickexpert and @seeitmarket

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.