The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Amid an onslaught of fourth-quarter earnings reports, dividend change announcements are to the positive side in a big way

- Walmart announced a 3:1 stock split – is a new wave of split activity on the way?

- Sentiment appears to be trending better despite macro uncertainties

With a hefty chunk of Q4 earnings reports in the books, total profits for S&P 500® companies look to have been roughly unchanged from the 2022 sum, according to the latest FactSet numbers.[1] It was a tough year on the macro front with rising interest rates and the looming threat of a snapback in inflation, not to mention all those pessimistic economist projections for a US recession. Furthermore, tepid growth in Europe and soft indicators across the board in China cast a cloud over the global economy.[2] Still, companies managed to hang in there and reward shareholders.

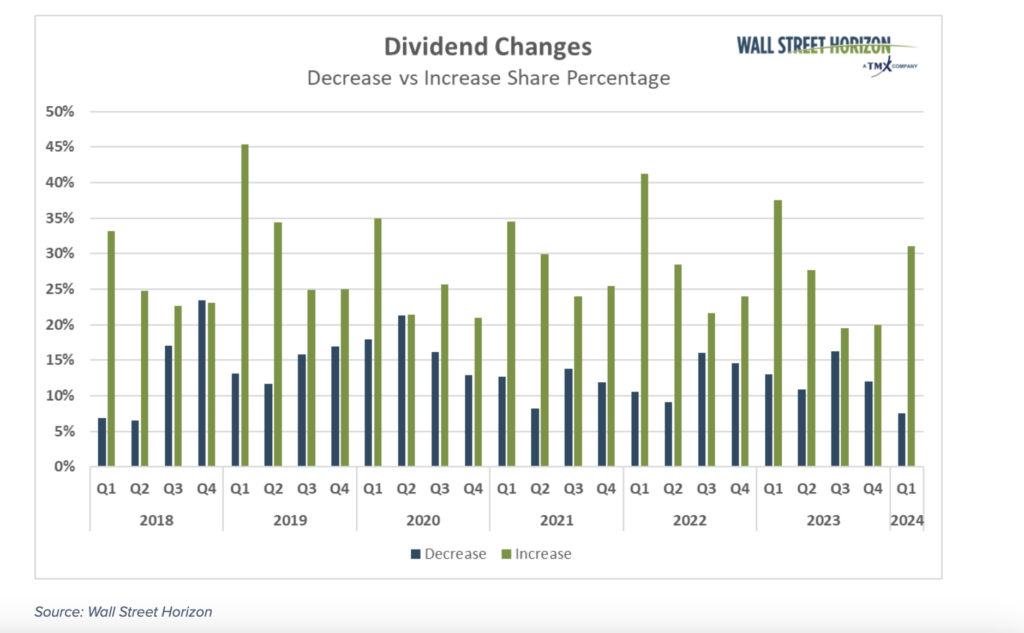

Our team noticed a positive development on the dividend front. For more than six years, Wall Street Horizon has been tracking dividend change announcements from thousands of companies across the globe. While early, Q1 of 2024 is on pace to boast the strongest ratio of dividend increases to decreases since the first quarter of 2018. Typically, the beginning of the year is when we see the greatest number of dividend hikes relative to cuts. It plays into the narrative that firms want to get the new year started off in an optimistic light.

A Bullish Dividend Increase-to-Decrease Ratio

Through January, among all companies in the Wall Street Horizon universe of 10,000 companies worldwide, 31% have announced a dividend increase compared to just 8% slashing their payout. The ratio of increases to decreases is better than 4:1, and if the decreases drop below 7%, it will mark the lowest quarterly percentage of companies announcing a dividend decrease in over 6 years.

The big caveat here is that the back half of earnings season tends to be more focused among non-US companies and smaller firms. Amid tighter financial conditions last year, a continued strong US dollar, and uncertainty abroad, it’s possible that we could see the ratio of dividend hikers to cutters take a dip over the next several weeks. That’s something we will no doubt keep our eyes on.

Dividend Change Announcements Since 2018: A 4:1 Increase to Decrease Ratio

Still, the bulls should be pleased to see this development so early in the year. It buttresses the backdrop of US real GDP growth that was better than expected last quarter while inflation, on some metrics, is already back down to the Fed’s 2% target.[3] Our indicator should also serve as a reminder that while the macroeconomic landscape is important, many of the world’s biggest companies are simply excellent executors – able to produce profits and cash flow while rewarding shareholders through dividends and buybacks.

A Better Consumer Tone

The more sanguine dividend outlook coincides with more upbeat consumer sentiment. Recall the recent University of Michigan Surveys of Consumers and last week’s Consumer Confidence survey published by The Conference Board.[4] Both reports pointed to the same thing – the vibes appear to have turned a major corner.

Even when folks felt in the dumps about the state of the economy in 2023, they were still spending, evidenced by strong Retail Sales reports put out by the Census Bureau throughout last year, particularly over the final two quarters.[5] Budgets may feel strained when parsing bills at dinner tables across the land, but real wage growth remains positive, and the unemployment rate hovers not too far from multi-decade lows.[6]

Stock Splits: Where Have You Gone?

Another trend our data team eyes is how 2024 unfolds with respect to stock splits (remember those?). In 2021 through mid-2022, stock splits were all the rage. High-profile names like Alphabet (GOOG), Amazon (AMZN), NVIDIA (NVDA), and Tesla (TSLA) led the charge following strong gains off the March 2020 stock market low.

Management teams might choose to split their stock to increase perceived affordability among individual investors, improve liquidity to attract a broader range of investors, make their stock psychologically more attractive to buy, or even increase options trading on the underlying shares.

A Big Month for a Big Retailer

While we don’t see a sudden resurgence of traditional stock splits among today’s biggest companies, Walmart (WMT) announced a 3:1 split on January 30, 2024. Payable on February 23 to shareholders of record on the 22nd, WMT will begin trading ex the split on Monday, February 26.

Before that, though, the world’s biggest retailer by revenue reports its Q4 figures on Tuesday, February 20 with a conference call shortly after the numbers cross the wires. You can listen live here. Retail earnings season will be key as it spans the all-important holiday shopping period.

Strong Spending, Strong Profits, Higher Dividends?

The National Retail Federation (NRF) reported last month that consumers were in full swing ahead of and during the holidays. Total holiday spending grew to a record $964.4 billion, meeting the NRF’s forecast despite those same tough macro conditions mentioned earlier.[7] A healthy labor market led to robust spending which, in turn, appears to be helping companies’ bottom lines across sectors. It’s reasonable to link that to our data’s sanguine dividend story.

Investors must always be on guard for what could disrupt this positive string of events. Uncertainty persists about what the Fed will do next while geopolitical jitters cast clouds over important parts of the global economy. Furthermore, following the strong run-up off the October stock market lows, the bar is likely higher today.

The Bottom Line

There are indeed many moving pieces as we venture further into 2024. Earnings reports keep rolling in, and there are positive developments on the dividend front. A near-record-high ratio of dividend increases to decreases is welcome news, perhaps a clue that CEOs and CFOs feel strong enough to reward shareholders. And will Walmart launch a new wave of stock splits? We’ll be watching.

Sources:

[1] Earnings Insight, FactSet, John Butters, February 2, 2024, https://advantage.factset.com

[2] EU exec cuts euro zone 2023 growth forecast, sees rebound in 2024, Reuters, Jan Strupczewski, November 15, 2023, https://www.reuters.com

[3] The U.S. economy grew at blistering 3.3% pace in Q4 while inflation pulled back, CNBC, Jeff Cox, January 25, 2024, https://www.cnbc.com

[4] Consumer sentiment surges while inflation outlook dips, University of Michigan survey shows, CNBC, Jeff Cox, January 19, 2024, https://www.cnbc.com

[5] Retail sales rose 0.6% in December, topping expectations for holiday shopping, CNBC, Jeff Cox, January 17, 2024, https://www.cnbc.com

[6] Real Earnings Summary, U.S. Bureau of Labor Statistics, January 11, 2024, https://www.bls.gov

[7] NRF Says Census Data Shows 2023 Holiday Sales Grew 3.8% to Record $964.4 Billion, National Retail Federation, J. Craig Shearman, January 17, 2024, https://nrf.com

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.