This article was written by Michael Kops – Vice President and Partner, Heartland Advisors.

It’s not just the stock market that’s seen a spike in volatility. It’s opinions about the stock market from so-called market experts.

The rapid-fire change in outlook was driven home for me the other week when two news alerts came out that showed just how fickle views can be.

The first headline blared that a global bear market was just getting started. Less than 24 hours later, most everyone then agreed the markets were primed to rally in 2019.

The whipsaw of opinion would be funny if it weren’t for the headaches it causes professionals trying to be the voice of reason for clients who understandably fear the unknown. It would be irresponsible for me to add to the noise of short-term predictions by offering up yet another guess dressed up with investment buzzwords.

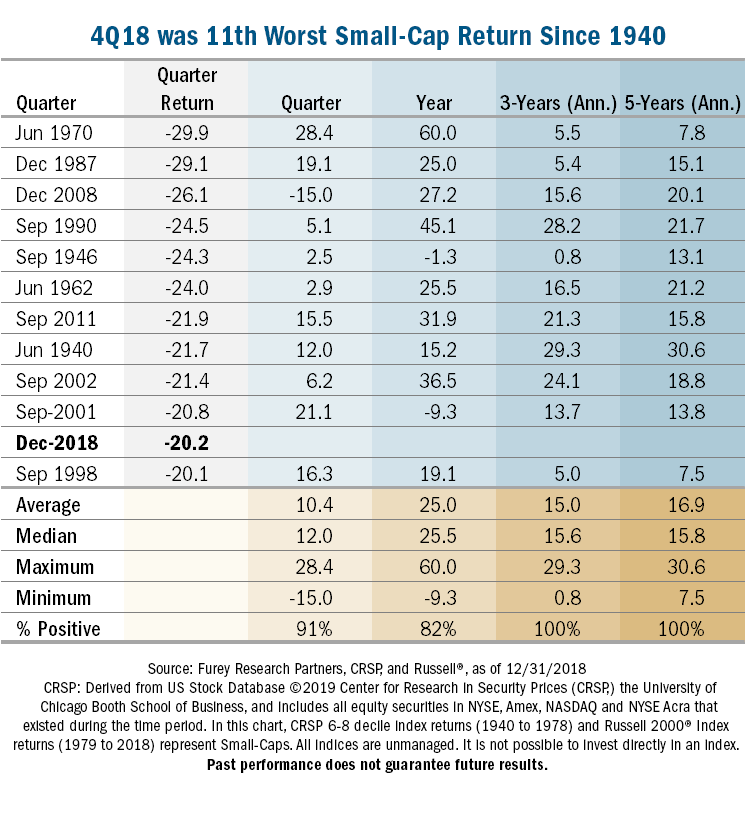

Instead, I’ll leave you with the chart below that shows how shares of small companies have performed after other sharply negative quarters and spikes in stock market volatility.

Do these numbers mean that we’ll see a double-digit rebound in the coming weeks and months? Honestly, no one can say.

What they do suggest, in my view, is that investors who have taken a longer view, or have avoided falling victim to the never-ending cycle of analysis, have historically done pretty well for their clients.

Heartland Advisors Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in this article are those of the presenter. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Definitions: American Stock Exchange (AMEX): the third-largest stock exchange by trading volume in the United States. Bear Market occurs when the price of a group of securities is falling or is expected to fall. NASDAQ: is a global electronic marketplace for buying and selling securities, as well as the benchmark index for U.S. technology stocks. NASDAQ was created by the National Association of Securities Dealers (NASD) to enable investors to trade securities on a computerized, speedy and transparent system, and commenced operations on February 8, 1971. New York Stock Exchange (NYSE): is based in New York City and considered the largest equities-based exchange in the world based on total market capitalization of its listed securities. NYSE Arca: is a securities exchange in the U.S. on which stocks and options are traded. Russell 2000® Index: includes the 2000 firms from the Russell 3000® Index with the smallest market capitalizations. All indices are unmanaged. It is not possible to invest directly in an index.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.