Stocks are in a bearish trend since the start of the year, after the Federal Reserve came out with a hawkish policy outlook to fight inflation. And other central banks have followed in the same decision, only adding to the bearish tilt.

However, if the recession risk gets worse then this policy may quickly come to an end. And should this occur, stocks may be looking for support after the first shock lower.

Today, I want to turn our attention to the German DAX and our Elliott wave analysis as I think that stocks could be setting up for a rally despite the no “recession” nod from the FED during the FOMC minutes this week… and despite a strong NFP number. Keep in mind that good data means more hikes, which is bearish stocks. But stocks are holding some support despite these events, so in my opinion there is room for more upside into next week.

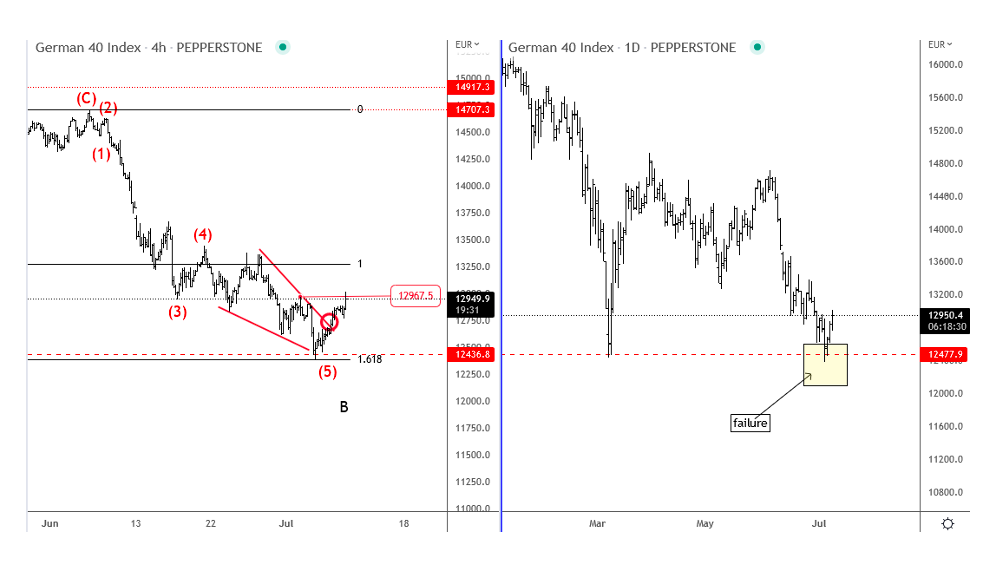

Below is a chart of the German DAX. The broad index is showing an ending diagonal pattern that completes five waves of decline from 14700 with a failure breakdown at the 12470 March low. I think there is room for 13500 or higher while this low is in place.

If you like our work, you can check out our Elliott wave services.

Twitter: @GregaHorvatFX

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.